Fintech Development Outsourcing: Your One-Stop Guide

The finance and banking industry has a long history. But the tech progress in combination with evolving customer demands and expectations that we can observe today brightly demonstrates the need for change. Traditional approaches and solutions have been efficient for many years. However, they can hardly cope with the tasks that banks and financial institutions need to deal with today. And here is when fintech projects should enter the game. These projects leverage the potential of new technology to compete with traditional approaches in delivering financial services to customers.

With the expansion of this sector and its growing role in the market, the demand for fintech software development services is moving higher. A lot of businesses that have ideas for fintech products do not have in-house resources for transforming their ideas into real solutions. But thanks to the flexibility of modern business models, it doesn’t mean that they do not have a chance to proceed with the creation of their apps. In such a case they always can turn to fintech development outsourcing and have their solution built by an external team of professionals.

In this article, we are going to explain what benefits and new opportunities you can enjoy if you opt for fintech software outsourcing, what models of establishing cooperation with project teams exist, and how you can reduce project costs thanks to working with fintech offshore developers.

Fintech industry: Quick overview

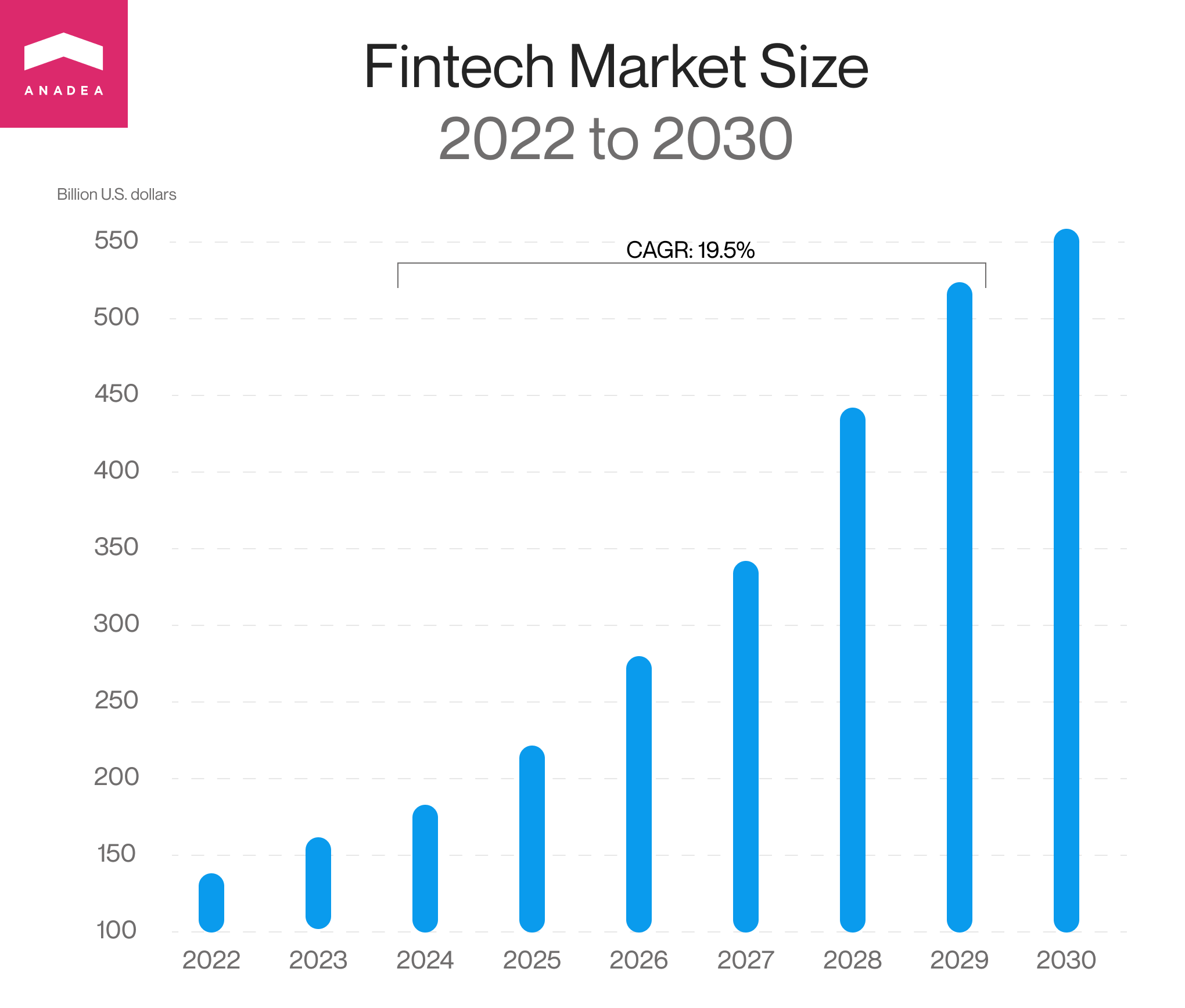

Before we proceed to the discussion the fintech outsourcing as a concept, we offer you to have a look at the recent statistics. The global fintech market size was valued at $113.84 billion in 2022. According to experts, this figure will be able to hit the mark of over $556.5 billion in 2030. It means that the CAGR over the analyzed period will be 19.5%.

Of course, at the current moment, we can’t say that fintech companies can fully replace banking and financial institutions in the near future. However, the role and significance of fintechs shouldn’t be underrated.

Fintech companies are shaping the direction for the further evolution of the finance industry by making financial services more cost-efficient, compliant, and accessible to customers.

As of June 2023, there were 335 fintech unicorns while at the beginning of the year, this list included 329 companies. Their total market value is around $1.549 trillion. Among the most prominent fintech firms, we should name Shopify, Ant Technology, PayPal, Adyen, Stripe, Block, Revolut, and others.

The industry is growing which may be a good sign for those who are considering an option of entering the market with new fintech solutions. In one of our previous blog posts, we shared our expertise in building fintech mobile apps. That’s why if you are planning to create such a product, our article will be of great use to you.

However, building a high-quality fintech solution may be not as straightforward as it may seem and is often associated with a row of challenges that you should be aware of, like:

- System vulnerabilities;

- The necessity to introduce strong protection of sensitive financial and personal data;

- Integration of third-party services, etc.

To address these difficulties in a proper way, you need to have a team of professional developers by your side. Nevertheless, not every fintech startup is ready to create and further maintain an in-house development team. That’s one of the major factors that boost the popularity of fintech development outsourcing.

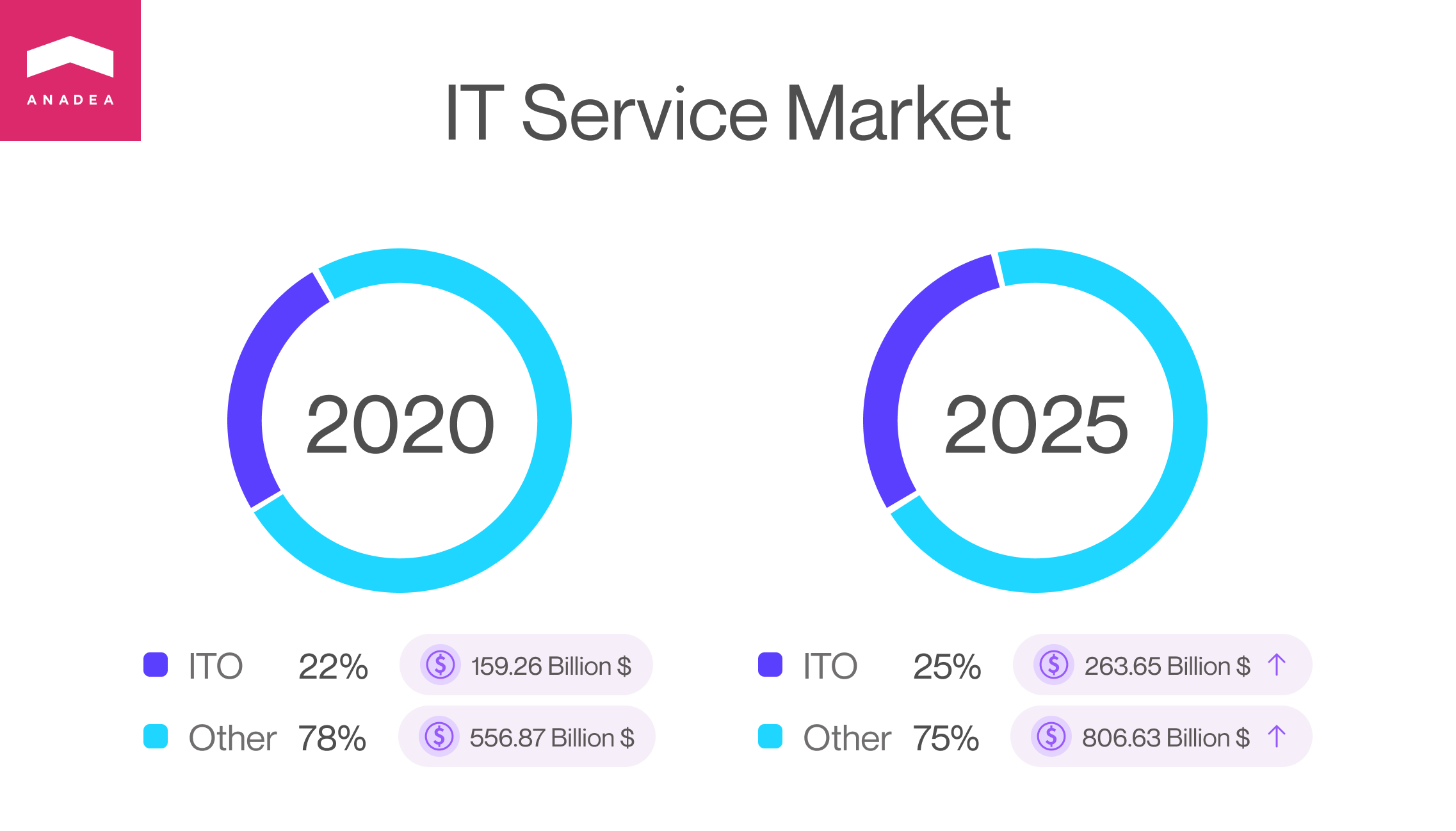

The rise of fintech outsourcing

IT outsourcing (ITO) is the largest segment of the IT service market and it is expected to exceed $430 billion in 2023. In 2027, it can reach a size of over $587 billion. The expansion of the ITO segment will happen at a CAGR of 6.68%. Moreover, it is predicted that the share of IT outsourcing in the general IT market will be gradually growing as well.

As it is quite natural, fintech development outsourcing is also included in the IT outsourcing segment and, consequently, follows all the general trends. Researchers revealed that outsourcing accounts for nearly 18% of the total spending in the fintech sector. Fintech firms outsource various services like back office tasks, customer service, data analytics, and others but product development and tech support services are among the most popular ones.

What businesses usually turn to fintech outsourcing?

- Startups. It is a widely known fact that among those companies that outsource software development services, there are a lot of young businesses and startups. Small companies that are just starting their business journey often can’t actively expand their in-house staff and outsourcing can be a good way out for them. This model helps them to reduce development costs and minimize risks of failure.

- Mid-size businesses. Thanks to fintech software outsourcing, mid-size companies can concentrate more on their core business functions and goals. As a result, outsourcing can be viewed as one of the ways to increase total business productivity and ensure the excellent quality of software solutions that will be built by professionals.

- Enterprises. Very often enterprise-level businesses work with outsourcing partners in order to optimize development costs and to allow their inner teams to focus on core projects.

Benefits of fintech development outsourcing

Sometimes when our customers come to us, they are not sure whether it will be a feasible option for them to work with an external development team or it will be better to hire in-house developers. Based on our experience, we can define a row of advantages that you can enjoy if you choose to outsource fintech development instead of building software in-house.

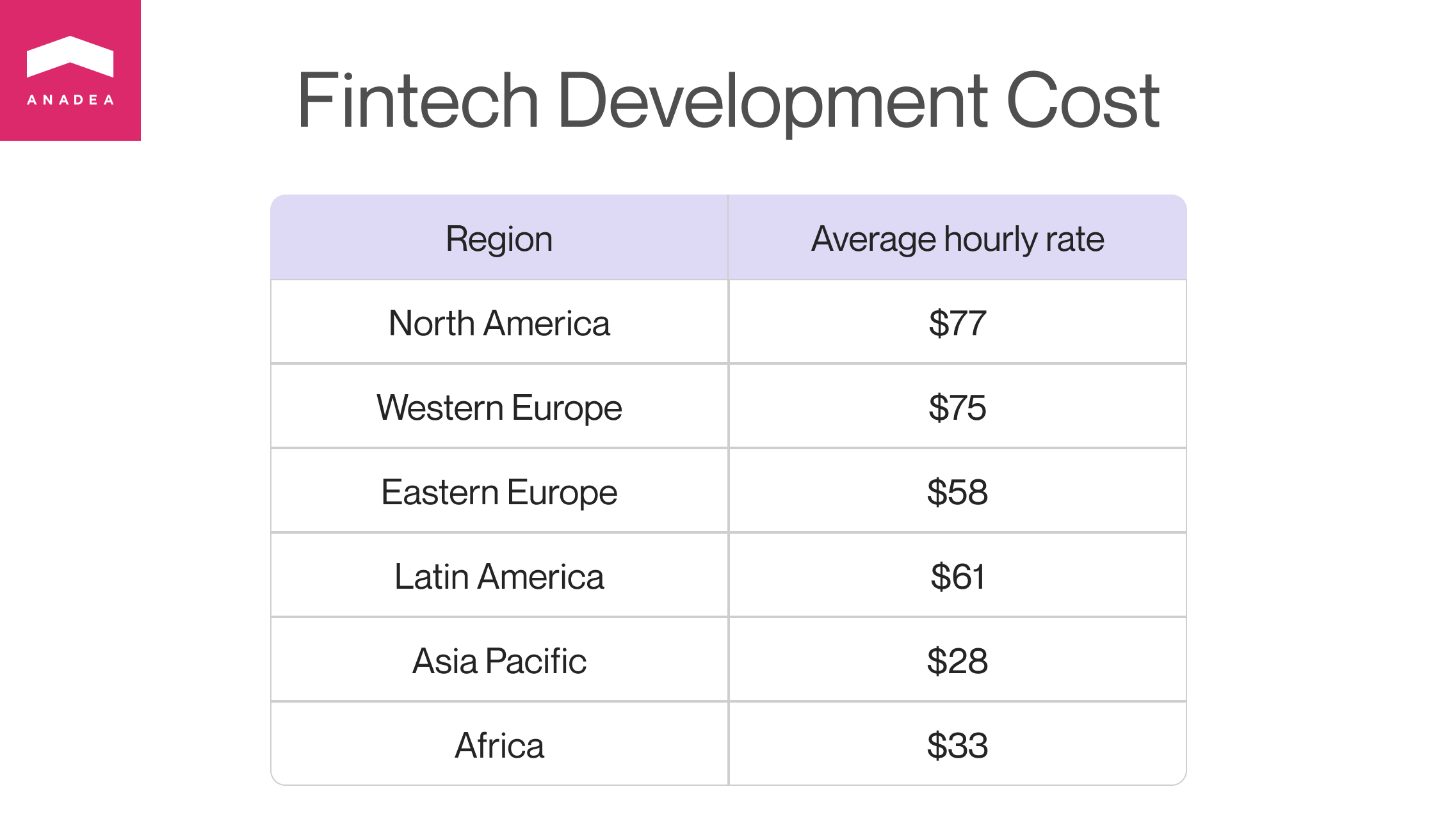

- Cost-efficiency. The chance to significantly reduce development costs remains one of the top reasons for businesses to outsource such services. Thanks to fintech outsourcing, you can decrease your project budget by 2-4 times in comparison to the cases when you decide to rely on your inner resources in building software. The rates of developers greatly vary in different regions of the world and such countries as the US and Canada are among those that have the highest rates. That’s why many businesses from this region, prefer to work with fintech offshore developers. For example, at Anadea we have an average hourly rate of around 50$, while for working with onshore teams in some countries costs can be 1.5-2 times higher.It is also important to bear in mind that when you work with external developers, you can avoid a lot of expenses related to office rent, equipment, taxes, bonuses, etc.

- Access to niche experts. When you are looking for in-house specialists, the area of search is quite limited. In the majority of cases, you can look for developers only in your city. As a result, it can happen that your local labor market won’t be able to satisfy your demand. But when you turn to fintech software outsourcing, you can work with development teams from all over the world and cooperate with experts with the rarest skills and specialized knowledge. However, to leverage this opportunity, it is necessary to find a company with a rich talent pool.

- Productivity and speed of development. There are several factors that help outsourcing companies speed up the development process and demonstrate excellent final results. First of all, a good software development company should have its own approaches and methods to support well-organized work processes. Secondly, when specialists with relevant knowledge are working on a project, they need less time to fulfill tasks as they exactly know what and how should be done.

- Risk mitigation. A professional development team can help you better manage risks such as security breaches, hacks, and data leaks. If your in-house developers have never built fintech solutions before, it can be rather challenging for them to find the right approach to protect your software and users’ data. With fintech experts, you are on the safe side.

- Improved quality. Outsourcing allows you to work with specialized fintech development teams that have rich experience in this industry and a deep understanding of all the ongoing market trends and needs. Thanks to this, such teams can deliver outstanding products that will not only fully correspond to your requirements but will also bring real value to end-users. Moreover, when you work with seasoned professionals you can expect to get helpful recommendations on how to make your personal financial app or any other fintech solution even better than you have initially planned.

Types of fintech outsourcing models

If you are considering fintech development outsourcing, before making a decision, you need to find out what options you have. There are several models of outsourcing that are defined based on different parameters. In this section, we’ve gathered the basic information for you that can help you to make up your mind.

Geography

Depending on the region where you are going to outsource development services, there are the following options: local(onshore), nearshore, and offshore outsourcing.

Local outsourcing presupposes that you will work with the development team that will be based in the region (or country) where your business is situated.

Pros of onshore outsourcing:

- The same (or very close) time zone;

- No cultural or language barriers;

- The possibility to organize offline meetings if required.

Cons of onshore outsourcing:

- Service price (if we are talking about such countries as Canada or the US, the rates of developers in this region are very high);

- Limitations related to the availability of specialists with the required skills.

Nearshore outsourcing of development services includes establishing cooperation with a company that is located in one of the neighboring countries. This model is considered to be something like a transitional format between hiring local and offshore teams. It unites some of the strengths of the other two models: similar cultures and the possibility of reducing development costs

Advantages of nearshore outsourcing:

- Insignificant time zone difference;

- The possibility to save money by reducing project costs (however, in the case of offshore outsourcing your savings can be even more serious).

Disadvantages of nearshore outsourcing;

- Possible language barrier;

- Geographical proximity (you may ask us why it is a disadvantage. But geographical proximity in outsourcing usually means that your development team may face the same economic, social, and political risks that you have in your home country).

The concept of fintech offshore outsourcing is based on the idea of hiring a development team that can reside in any country of the world, including other continents and the most faraway regions. For example, if a US-based firm works with developers from Spain or Poland, for example, it will be offshore outsourcing.

Benefits of offshore outsourcing:

- Lower development costs without product quality deterioration;

- Access to a global talent pool and the possibility to find experts with niche skills.

Drawbacks of offshore outsourcing:

- Significant time zone difference;

- Possible cultural barriers;

- Possible difficulties in communication.

There is also a quite popular opinion that offshore outsourcing is a quite risky idea as it may be practically impossible to execute control over the development process, you won’t meet programmers face-to-face, and they may feel practically no responsibility for what they are doing.

But let’s be honest, the same attitude can be also found, even if you hire developers from your city. Everything depends on your outsourcing partner and there is no difference where this company is based.

As for other disadvantages of this model like time zone gaps or language barriers, everything can be discussed beforehand. You can indicate a command of English among the key requirements for a development team and ask for flexibility in the working hours of programmers and other team members.

Type of cooperation

There are two most popular models: dedicated development teams and project-based cooperation.

When you opt for the dedicated team model, you will hire specialists who will be 100% focused on your project, will work full-time, and will be controlled and managed by you. But at the same time they will be officially employed by your outsourcing partner and all the administrative tasks won’t be your responsibility. Based on the principles of this model, you can hire a full development team or several experts who will join your in-house developers.

Advantages of the dedicated team model:

- Full control over the development process;

- Fast hiring (in comparison to in-house hiring);

- No headhunting, recruiting, and other administrative issues;

- Cost control and team composition flexibility (you can easily change the composition of the team at any moment when it is required);

- Good option for long-term projects.

Disadvantages of the dedicated team model:

- The necessity to manage all the processes on your own;

- Possible language and time zone issues;

- Inefficiency for short-term projects.

Project-based outsourcing includes delegating the entire project (or its part) to an external team. If you choose this model, you, as a customer, will need to provide detailed requirements to a development team and then, they will be fully responsible for building your solution (or some part of its functionality).

Benefits of project-based outsourcing:

- The possibility to focus on core business activities instead of controlling the development process;

- The possibility to use this model for projects of different types.

- Drawbacks of project-based outsourcing:

- Limited control over the project realization;

- Increased project costs if you also use additional services like business analysis, QA, and project management;

- The necessity to provide all the requirements at the very beginning.

Both approaches have their strong and weak sides. It means that you will need to consider each of them in the context of your own situation. Are you ready to fully rely on an external team or do you want to manage the processes? Will you be able to provide detailed requirements or do you need to have some flexibility? These are only a couple of possible questions that you will need to answer to make a decision. If you have any doubts regarding the model of cooperation, at Anadea, we can always help you to define the best option.

Hybrid outsourcing model

This concept is based on the principle of blending several outsourcing types and schemes with a view of achieving the best outcomes, including the highest quality of final products, the most efficient collaboration, and the most optimal costs.

There are various types of the model. Among the most common options, we can recollect the cases when companies combine onshore fintech outsourcing and in-house development. In this case, the outsourcing team that you hire can work closely with your in-house staff to speed up the development.

Another case that can demonstrate the benefits of the hybrid model is outsourcing services onshore and offshore. Thanks to this, you can not only work with specialists with different backgrounds but also organize 24/7 work processes. However, you should understand that it can be a very challenging option.

Pros of hybrid outsourcing:

- Flexibility and team scalability;

- Cost efficiency;

- Work with specialists from different regions;

- Unique business processes.

Cons of hybrid outsourcing:

- Difficulties in the organization of work of all the teams;

- Communication between different teams;

- Different approaches used by teams that should be well-combined together.

What fintech services can be outsourced?

When businesses start viewing fintech software outsourcing as a viable option for them, they always need to find out what services can be performed by external teams. Actually, we won’t exaggerate if we say that today practically all the functions that are performed by in-house teams can be performed by outsourcing companies.

Below you can find the most popular fintech outsourcing services.

- Development services. You can either hire a full-stack team or rely on external developers only for building a back-end or front-end part of your solution.

- QA services. They can be outsourced together with development services or separately. It means that you may build a solution in-house but hire an outsourcing company that will test your software and make sure that it is compliant with all the relevant regulations and rules.

- Customer support. When you launch a fintech app, it is necessary to think about customer support services. If you do not have in-house specialists for performing these tasks, you can find a vendor that offers such services. You can organize customer support via an online chat or a call center. As a supportive tool, you can also introduce an AI-powered chatbot.

- Data analytics. For fintech companies, it is essential to efficiently work with huge volumes of real-time data. However, data collection, processing, and interpretation can be very time-consuming and challenging tasks, especially if you have a small team. That’s why a lot of fintech startups prefer to outsource such services.

How to choose the right outsourcing partner?

As we have already mentioned, when it comes to any type of outsourcing, and fintech outsourcing is not an exception, it is vital to choose the right company that will provide you with such services. Unfortunately, today there are quite a lot of unfair market players who can’t do what they have promised. That’s why you need to be very attentive in order to avoid unpleasant situations that may lead to financial losses, missed deadlines, and unfulfilled plans.

But even if you are sure that you’ve found an honest and responsible team, it is necessary to analyze whether it has all the required skills, knowledge, and resources for building your solution. It means that it is also required to check the exact areas and business domains where the company has expertise. You can also always ask a company to share its portfolio with you. It will be cool if the team has already built similar solutions. If you want to know what fintech projects we have worked on, please follow this link to get some details about the solutions that we’ve successfully developed.

What are other factors that you should pay attention to?

- Reviews. Before establishing cooperation with a fintech outsourcing partner, read the reviews written by people who have earlier worked with this company. We recommend you check such business platforms with rankings and reviews as Clutch and GoodFirms.

- Cultural fit. Though we are living in the era of globalization, some cultural differences still exist which may become a barrier to efficient collaboration. People in different cultures have different attitudes to responsibility, openness in communication, and deadlines. That’s why many businesses prefer to work with companies from similar cultures. However, even if you want to hire fintech offshore experts, you can find teams with similar values. To avoid cultural issues, companies from North America prefer to work with European teams. Moreover, as a rule, software developers in Europe have an excellent command of English.

- Communication channels. Such questions as a way and means of communication should be discussed with your development partner in advance. It is important to make sure that the chosen communication tools would be convenient for all parties. Moreover, the chosen tool should guarantee that you and your partner will be able to quickly get information and react to it. As a rule, today in the software development industry, businesses use various messaging and video call apps like Slack, Skype, Zoom, and others.

- Test tasks or trial periods. It is crucial to have the right people doing the right things. In the case of fintech software outsourcing, before investing the entire amount in the development, you should check whether the chosen team will cope with your project. That’s why a lot of outsourcing companies offer trial periods or agree to fulfill test tasks in order to make customers feel comfortable. If you are not satisfied with the results, it’s better to look for another partner.

Fintech development outsourcing: How much does it cost?

There is one more important aspect that our clients always ask us about. It is pricing. Well, it depends. There are a lot of parameters that may affect pricing (like the complexity of your project, the tech stack, the rates of developers, etc.). One of those parameters that will have the strongest impact is the region of hiring. As we’ve already discussed in our article in the section about onshore, nearshore, and offshore outsourcing, for US-based companies, it is often quite feasible to work with fintech offshore developers. The data below can brightly prove this idea.

Though in this table we’ve indicated the average data as of 2023, before establishing cooperation with a particular development team, please always check the approved rates beforehand. It will help to avoid a lot of unpredictable situations that can lead to serious financial issues in the future.

What else should you be aware of when it comes to prices and project budgets? That’s hidden costs, or in other words, any unforeseen expenses associated with getting some services. Unfortunately, some agencies offer very attractive prices by introducing rates without taking into account taxes that they will need to pay, equipment that they need to support, offices that they rent for their employees, etc. As a result, when their customers get bills, they are absolutely shocked to see amounts that are higher than those discussed initially.

Is it possible to avoid such unpleasant surprises? Yes, two important steps here are to choose a trustworthy vendor and to read attentively all the information provided in the agreement.

One more finance-related point that we’d like to pay attention to is the pricing model that you will choose. Hourly rates and fixed price are the two most widely applied options. Hourly rates presuppose paying for the actual time that the team has spent working on your project. In the case of the fixed price model, together with a vendor, you will need to approve the final cost in advance based on project requirements and preliminary estimates of time and resources that will be needed.

Let’s briefly summarize their pros and cons.

| Hourly Rates | Fixed Price | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

| When to use this model |

|

|

Risk management in fintech outsourcing

Any type of cooperation with external specialists who are not your employees may be associated with some risks and difficulties and you should be properly prepared for them in order to know how to address them correctly.

Data security and privacy

Developers often need to deal with sensitive data. However, in the case of in-house experts, we traditionally trust them, especially if they have signed an NDA (Non-Disclosure Agreement). With an outsourcing team, the situation can be a little bit more challenging. Without any doubt, you also should sign an NDA with your vendor. If it is possible, we recommend you use a digital signature. Among other measures that you can take, we should mention access control (make sure that sensitive data is available only to those specialists who really need to work with it), monitor the team’s activity, set very clear rules, and, of course, choose a reliable outsourcing company with an outstanding reputation.

Compliance and regulations

When you start working with developers, make sure that they clearly understand the peculiarities of regulations that will be applicable in your case. The fintech industry has a row of rules that can differ depending on the country. For example, the GDPR (General Data Protection Regulation) is the data protection and privacy regulation in the EU and the CCPA (California’s Consumer Privacy Act) is the US law aimed at protecting data and privacy rights. It is also vital to make your apps compliant with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

It is highly important to check all the laws and regulations that are in force in those jurisdictions where you are going to launch your solution.

Quality Assurance

The role of QA in the project’s success is usually much more significant than a lot of people think. By conducting tests of different types during and after the development process, it is possible to define and fix bugs and issues that might affect the app’s performance and functionality in the future. When we are talking about fintech software, it is of crucial importance to address all the vulnerabilities before making the app available to a wide audience. Otherwise, all tech issues can result in serious financial and reputational damages. QA tasks can be performed in-house or outsourced. If you prefer the second option, always discuss the methods that QA engineers will use in advance to make sure that their approaches fully meet your requirements.

Our successful fintech outsourcing projects

We work with projects from different industries and fintech is among them. Thanks to our experience in the software development market, we always can find the right approach to each project in accordance with the requirements received from a customer.

The first project that we’d like to talk about is Admirals by Admiral Markets, a trading app that offers more than 5,000 trading instruments. The project presented a unique challenge: to efficiently manage a massive amount of data processed every second, all while considering the limited resources available on various mobile devices. One of the co-founders of this trading platform found our company on Clutch and decided to contact us to get more information about our services. After some communication and discussion of the details, our team was hired to tackle these challenges. We applied an intelligent subscription/un-subscription approach to actual quotes, allowing users to always be up-to-date with trading data. Project management activities were also executed on our side. It was an example of excellent cooperation that required quite a lot of effort from our side. We did our best to address all the issues and continuously stay in touch with the customer.

Another case from our practice is MoneyZen, an Estonian P2P web platform for loans and investments. On this project, we were responsible for front-end and back-end development, design, business analysis, and marketing. When this company came to us, they already had a legacy backend. However, the platform couldn’t boast a large number of users due to its complicated processes. Our task was to address this issue and not only to offer a modern user-friendly design and enrich the platform with new features but also to find ways to make it look more attractive to borrowers.

After analyzing the case, we offered to integrate the legacy app with Estonian governmental services with a view to automating the registration for borrowers. We also introduced a row of advanced features that make the interaction with a platform easier and faster. Working on this project, we needed to get deeply involved in its specificity, requirements, and goals which is typically quite challenging for outsourcing teams. Nevertheless, our specialists coped with this task and helped the client to reach all the set goals.

Instead of a final word

As you can see fintech development outsourcing can become a good option for companies and projects of absolutely different types. It doesn’t matter whether you manage a startup or you have a huge enterprise, expanding your in-house staff with a development team can be a rather challenging, expensive, and time-consuming process. Instead of doing this, you can find a reliable outsourcing partner who will be able to perform your tasks with the highest level of excellence.

The concept of outsourcing includes different models that ensure the desired freedom of choice and flexibility for businesses. You can work with developers from your country or from another continent, you can outsource all the tasks related to your project realization or just one function. Everything depends on your business model and goals.

The main idea is that fintech software outsourcing can help you optimize your costs and provide the possibility to work with the best experts without spending your time on headhunting and recruiting procedures.

At Anadea, we are always open to new ideas and projects. If you need any help related to fintech software development, you can always rely on our team. With our rich talent pool and exclusive expertise in the fintech industry, we are sure that we will deliver the best results. As for the forms of cooperation, we do our best to stay as flexible as possible to build highly efficient and comfortable processes for everyone. Want to learn more about our services and rates? Just contact us!

Have questions?

- Fintech outsourcing is a business strategy that can be applied by fintech companies and projects. It presupposes hiring external specialists who will deal with a particular part of the in-house teams’ tasks and operations.

- This approach can help companies reduce costs, optimize the workload for in-house staff, and ensure the possibility for the team to concentrate more on its key business activities. Moreover, thanks to outsourcing you can get access to a global talent pool and cooperate with the best experts with niche skills.

Don't want to miss anything?

Subscribe and get stories like these right into your inbox.

Keep reading

P2P and B2B Real-Time Payments: Benefits for Businesses

Real-time payments are revolutionizing B2B, P2P, and cross-border transactions. Read our article to explore how you can benefit from these technologies.

How to create an investment app: Guide 2025

Planning to launch an investment application? It can be a very promising idea in 2025. Read our investment app development guide to launch a successful product.

Medication management app development: Guide for businesses

Medication management software is gaining popularity fueled by the benefits it can ensure. Read our article to learn more about its features and use cases.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.