Fintech Mobile App Development: Practical Tips

Though the traditional banking and finance industry has been growing and developing for centuries, today, it may seem that it is experiencing not the best times. The main issues are related to the lack of flexibility in its processes and its inability to cope with the continuously increasing number of clients, transactions, and tasks.

The market desperately needs new innovative solutions that will address the existing problems. As you know, an increase in demand inevitably leads to an increase in supply. And here the fintech industry comes to the arena as an alternative to a rather cumbersome traditional banking. In this article, we are going to talk about the growing popularity of new solutions, the peculiarities of fintech mobile app development, and share a row of recommendations that will help you to build a fintech app that will be welcomed by the market.

The current state of the fintech industry

Before speaking about fintech app development, we need to make sure that every person who reads this blog post has the right understanding of fintech. According to Investopedia, this term is used for describing the integration of technology into financial services which is done to improve their quality, accessibility, and the way of their delivery to customers.

Today it is too early to speak about the potential of the fintech industry to fully replace the traditional banking and finance industry. However, together with the growth of the demand for fintech software development services, we can observe the expansion of the fintech sector. At the current moment, it holds a share of 2% of the global financial services revenue which stays at around $12.5 trillion. But analysts expect that by 2030, the share of banking fintechs will be almost 25%. It means that from $245 billion, the revenues of fintech will grow to $1.5 trillion.

Fintech mobile app development services can boast their skyrocketing popularity these days because namely smartphones can be viewed as the main liaison between consumers and financial institutions. One of the core goals of every company that wants to build a fintech app is to guarantee easy access to financial services to everyone and especially to those who are currently unbanked.

And a mobile application is just the best way to do it With the enormous smartphone penetration that we can observe today (in some countries it is already around 80% and the global rate was 68% in 2022), it is quite logical to rely on mobile technologies in delivering financial services to people. Smartphones are always in our pockets, bags, or just somewhere nearby. Usually, just a couple of seconds are required to take a mobile device and open an app. Moreover, not every person who owns a smartphone has permanent access to a computer. That’s why we can say that financial mobile app development is the most relevant and feasible approach to delivering fintech services to users.

Benefits of fintech solutions for businesses and consumers

To estimate whether it is really worth investing in fintech apps development today, we suggest you have a look at the list of new opportunities that such solutions open to all participants of the financial market.

Let’s start with the advantages for consumers:

- Higher level of financial inclusion

- Availability of new products and services

- Personalized approach

- Speed of financial transactions

- Easy access to financial products

- Lower fees

- Enhanced transparency

And what benefits can companies leverage thanks to fintech app development?

- Optimized operational costs

- Access to business capital

- Enhanced cash flow management

- Higher client satisfaction and loyalty

- Increased security of transactions

- Automated accounting record keeping

- Streamlined payment process

All these benefits that we’ve enumerated are only a small part of those that businesses and consumers can enjoy thanks to implementing a fintech mobile app in their interaction. Moreover, there are a lot of industry-specific advantages. But one thing is obvious, financial mobile app development is always a win-win initiative for companies and their clients.

What technologies are used in fintech mobile app development?

If you have already started planning your fintech application development project and communicated with finance app developers, you’ve probably heard about ABCD of fintech. This acronym stands for the technologies that are widely applied in fintech solutions. They are Artificial Intelligence, Blockchain, Cloud Computing, and Data (Big Data).

- Artificial Intelligence (AI) and Machine Learning (ML). These technologies play an important role in the evolution of the fintech landscape today. They help to increase the automation of numerous processes, enhance efficiency, enable accurate predictions, and improve risk management. Moreover, by using AI-powered solutions, companies can deliver highly personalized services and experiences to their customers in full accordance with their ongoing needs.

- Blockchain. Though blockchain is widely associated with cryptocurrencies, crypto assets are only one of the use cases of this technology. Today blockchain is chosen by many companies for building their apps and storing their data. Blockchain platforms provide the possibility to record and spread digital information but prevent it from being edited. As a result, the transparency of all transactions is ensured. What’s more, thanks to blockchain you can fully exclude intermediaries from financial processes which will help you to make all operations faster and cheaper.

- Cloud computing. Cloud technologies are among the main boosters of the fintech sector’s growth. Cloud computing has fully revolutionized the way financial companies provide their services and organize their internal processes. With cloud platforms, companies can store, access, and process their data much more securely and efficiently than earlier. Cloud applications are also much more scalable and flexible than others and by using them, companies can implement new business models for enhancing user experience

- Big Data. Data is one of the most valuable business resources these days. And the better a company can work with its data, the higher the results it can achieve. But in the modern business world, the volumes of data are really huge which makes it absolutely impossible to process them manually and do it quickly. And that’s when Big Data analytics should enter the game. By getting valuable insights into customer demands, expectations, and requirements, fintech companies can adjust their services in such a way that they will precisely address the needs of their clients.

The evolution of these technologies and the achieved progress will greatly define the future of the fintech industry and fintech mobile app development services. It is expected that already in the near years we will be able to observe further expansion of the fintech sector. This growth will be greatly supported by the adoption of blockchain and crypto assets. At the current moment, different governments all over the world are working on the elaboration of solid regulation of this type of asset. Meanwhile, central banks of different countries are developing CBDCs (central bank digital currencies) that can fully change the way international transactions are conducted today. If all the current plans are realized, crypto will have just the same rights and power as fiat currencies have today in b2b, p2p, and p2b transactions.

Your fintech app awaits!

Finance mobile app development: Different types of solutions

The sector of mobile application development for fintech unites numerous app types. That’s why when you are planning to deliver such a solution, first of all, you need to make up your mind and choose what product you are going to build. We’ve prepared a list of app types that today are highly demanded in the industry. Nevertheless, it doesn’t mean that you should opt for just one type. For your custom fintech mobile app, you can choose several types of solutions, analyze their functionality, and combine their features in your unique software product.

Banking apps

Let’s put it as simply as possible. A digital banking app can be explained as a bank on your smartphone. Such applications provide users with access to a wide range of banking products and services. And what is even more important is that thanks to such apps, users can avoid the necessity to work with banks in a traditional manner and visit bank offices each time they need a consultation or when they want to make a transaction.

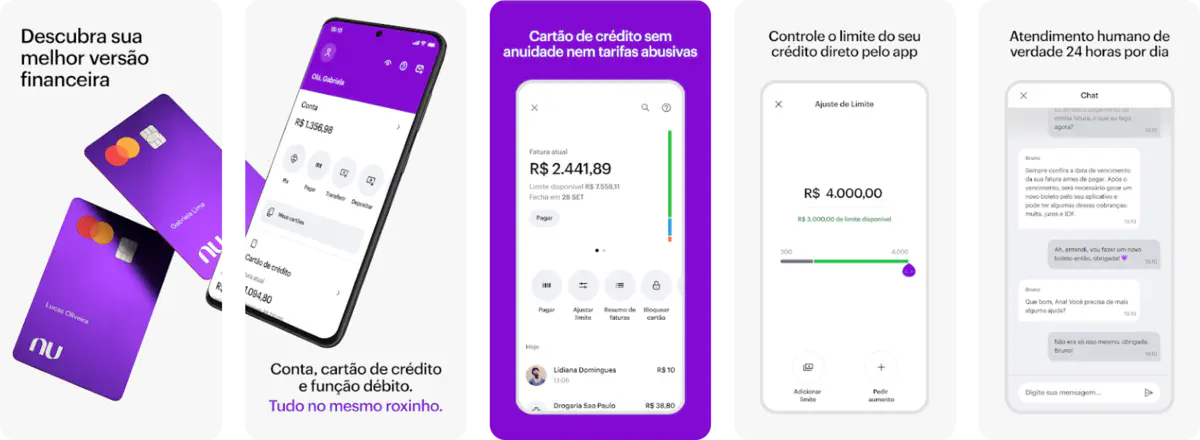

As an example of such solutions, we can mention an application run by Nubank, a Brazilian fintech startup that has won global fame. The company offers such services as instant money transfers, invoice management, spending monitoring, etc. People get free accounts, easy-to-use interfaces, and the possibility to earn rewards.

Payment apps

As it is clear from the name of this category, these apps offer functionality for making and receiving payments. They can be viewed as an alternative to traditional online payments that are performed with the help of credit and debit cards. On such applications, users should create their own accounts where they will store their funds. Money can be withdrawn and sent to bank accounts.

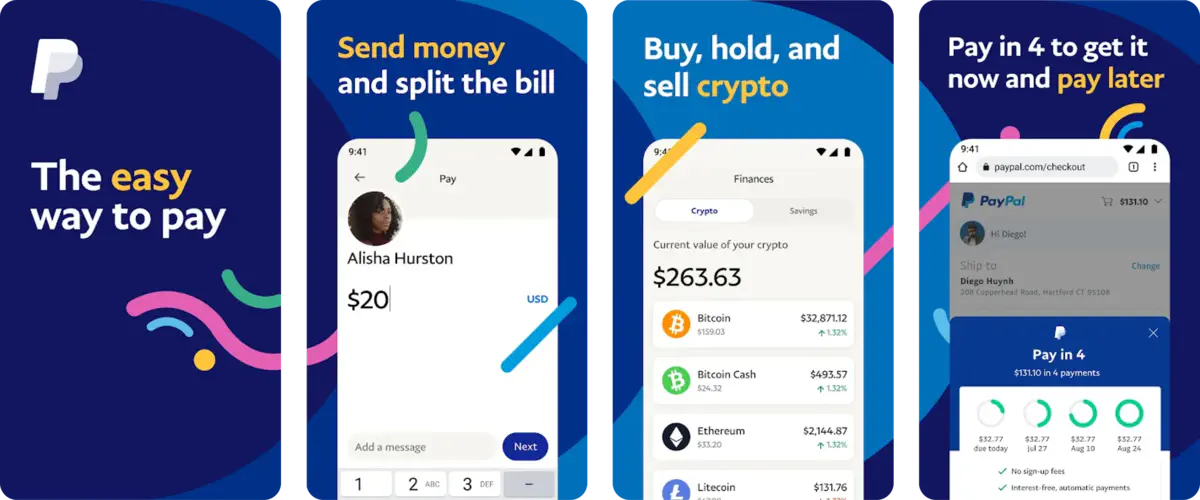

PayPal is a US-based fintech company that operates its online system for payments. Users can get access to the system via a web platform and mobile app. Today the company has over 426 million users from all over the world. The mobile app can be used for p2p transactions as well as for business financial operations and p2b payments.

Personal finance apps

Such apps provide users with convenient tools for managing their money. As a rule, they have functionality for tracking expenses, planning budgets, calculating savings, etc.

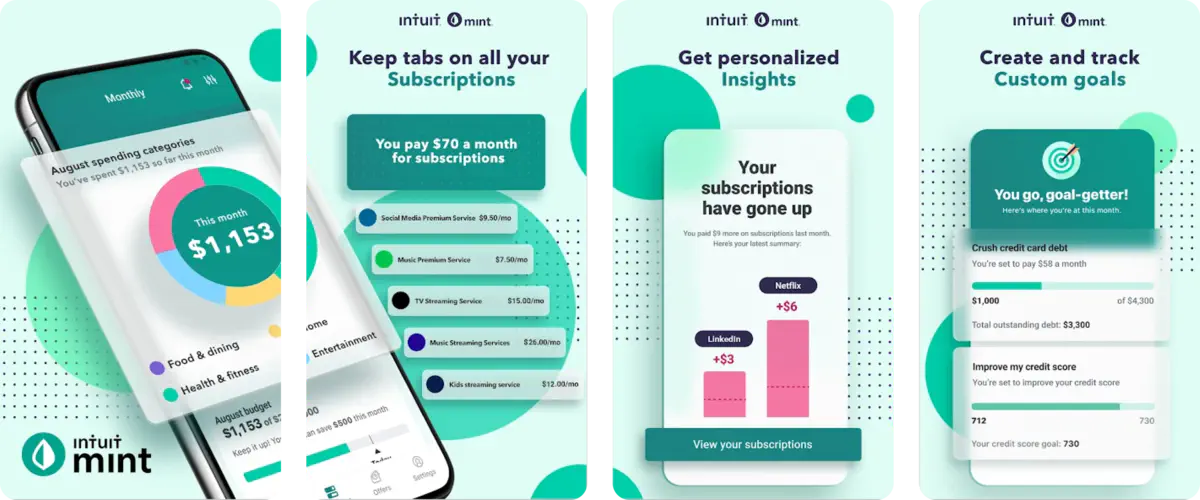

Mint by Intuit is a free application that provides people with the possibility to have a clear picture of their financial situation. A user needs to link a debit or credit card to the Mint’s account and the app will help to analyze all the transactions. All financial operations will be categorized and a user will see how the money was spent. With Mint, users can also track their bills and create budgets.

Stock trading apps

Investing today has become absolutely simple and available to a very wide audience. With the help of mobile apps, everyone can buy stocks of the most prominent Wall Street giants and get profits.

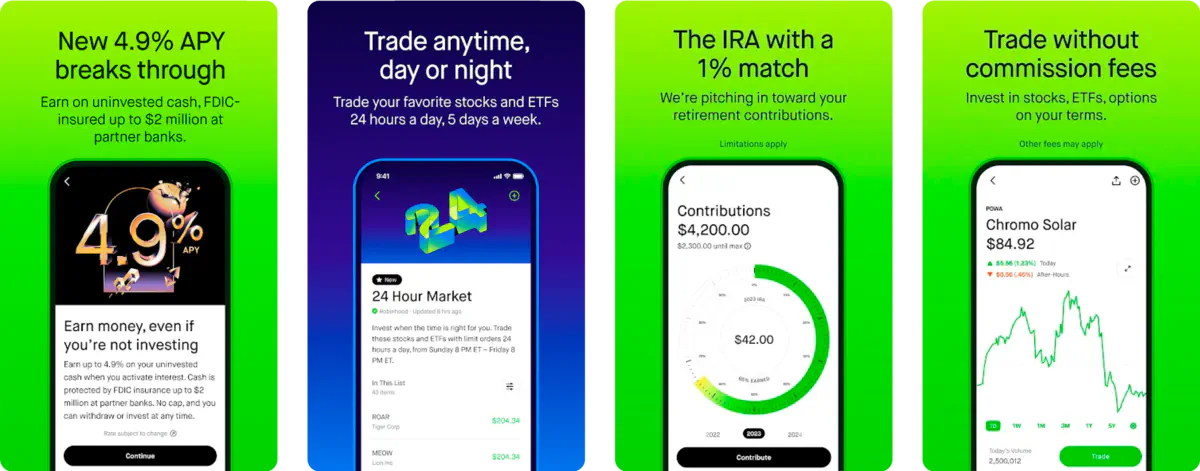

Robinhood is one of the best examples of such solutions. It was launched in 2015 and since then it has been offering zero-commission stock trading and other investment opportunities. The app is considered to be a good option for beginners who are interested in trading stocks, ETFs, and even crypto assets.

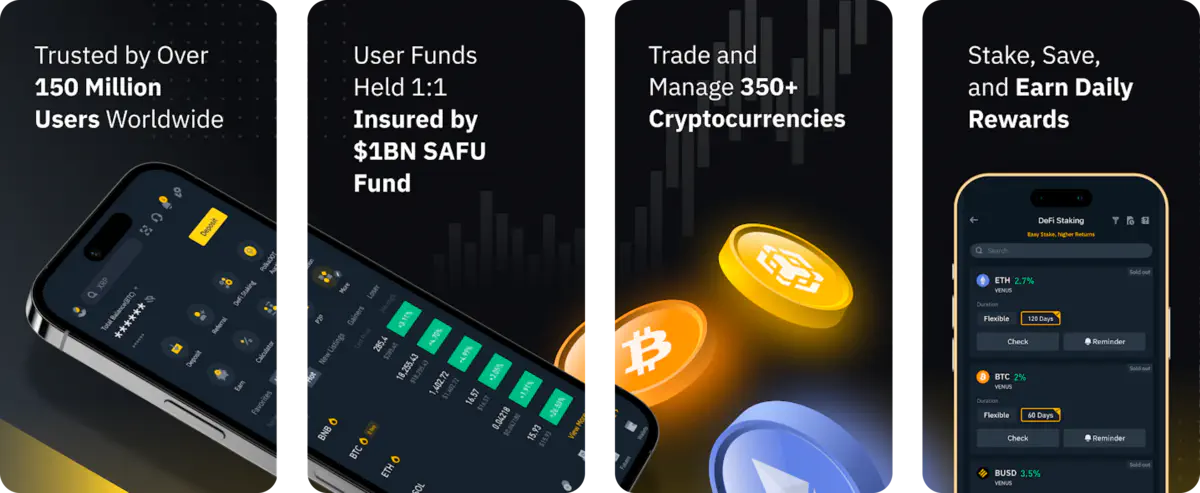

Crypto apps

The adoption of cryptocurrencies is gaining momentum. Though there are a lot of risks associated with investing in these assets, with the right approach and some portion of luck, it is possible to make money on crypto trading.

Practically all crypto exchanges, including Binance, Coinbase, OKX, and others, have their mobile apps today. That’s why users just need to find the most appropriate variant for them based on the range of trading pairs, size of commissions, and availability of the app in their region.

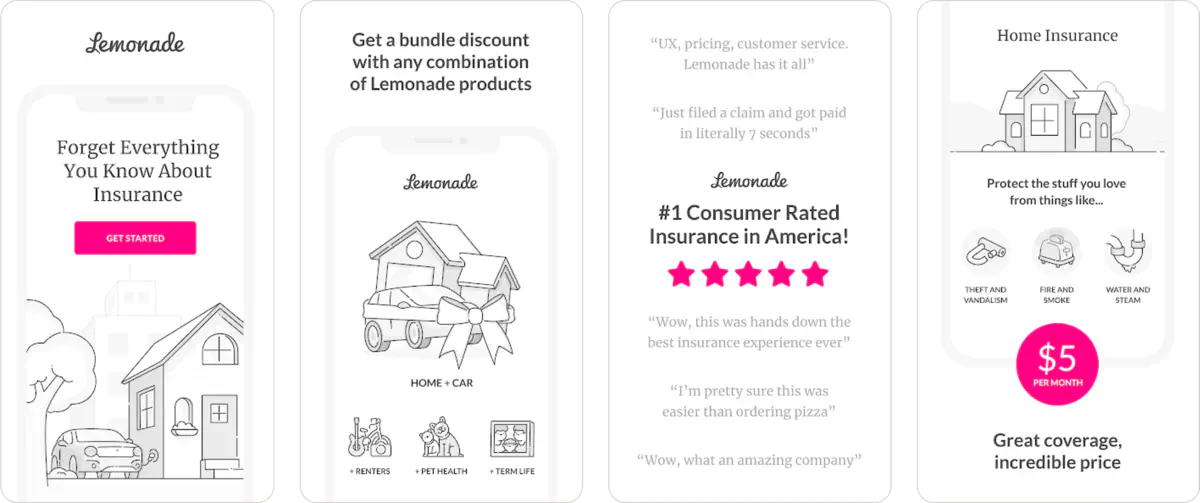

Insurance apps

Such apps allow users to find insurance programs based on their individual needs and to buy insurance policies online. Apps of this kind typically offer a very convenient search system that helps to find appropriate options within just a couple of seconds. Users just need to answer some questions and an application will offer suitable variants.

Lemonade is an AI-driven insurance app that relies on bots instead of brokers and allows users to avoid a lot of paperwork. By using this app, can find any type of insurance they can only wish for, analyze the terms, and buy the best option.

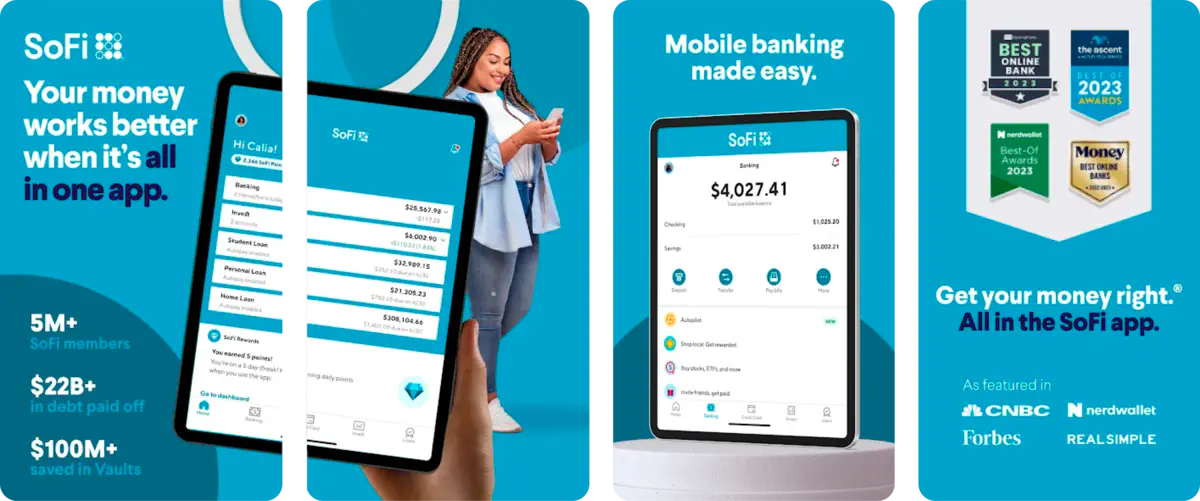

Loan apps

Now to take a loan it is not necessary to visit a physical bank office. It is enough just to download a loan app, view available options, and submit an application. Such apps allow users to calculate the feasibility of different options and make well-informed solutions.

SoFi’s mobile application is not only a loan solution, it also offers investments and banking functionality. However, the company has a wide range of loan products like private student loans, loan refinancing, and personal loans. For so-called smart money moves, users get points that can be redeemed for cash or used for loan payments.

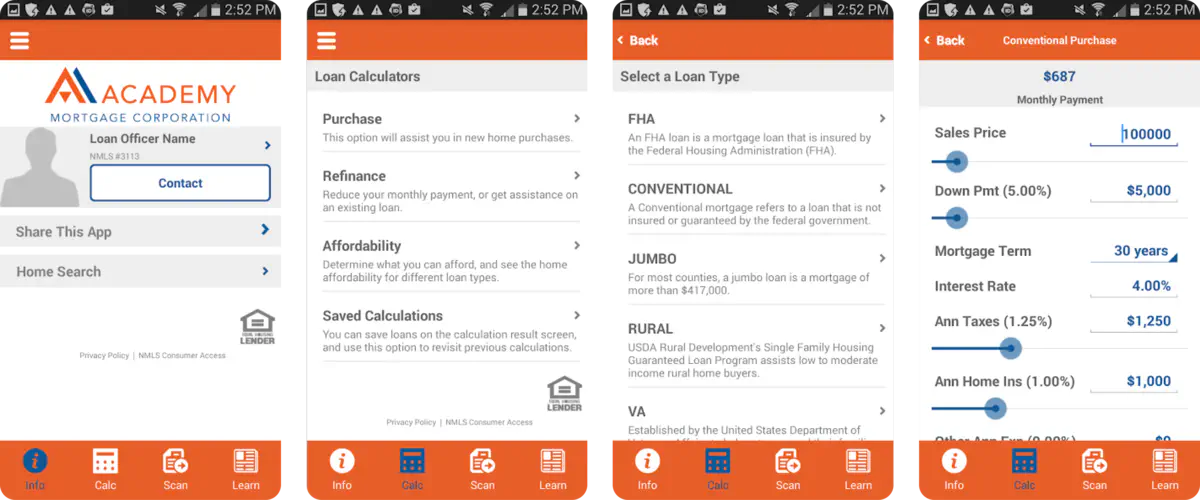

Mortgage apps

This is one of the types of loan software. They are intended for dealing with loans that will be used for buying real estate. A mortgage app provides access to a digital format of interaction between borrowers and lenders (credit unions, p2p platforms, banks). Usually, these apps offer such functionality as a mortgage calculator, submission of applications, payment management, and customer support.

My Mortgage: Mobile by Mortgage Academy is one of the apps that have very high rankings on the marketplaces. A solution allows users to compare different loan programs, calculate the feasibility of mortgage refinancing, stay in touch with their loan officers, and easily scan and store all the required documents.

What should you think about before fintech app development?

Though the stage of design and development is always believed to be the core part of any project that includes the creation of a software product, there is a row of other important things, steps, and issues that you shouldn’t forget about.

Idea

One of the most fundamental steps of any finance mobile app development project is ideation. Nevertheless, its significance is often underestimated. You need to elaborate a clear concept of your future solution, set tasks that it should fulfill, and find out what features should be built to make it possible to achieve the defined goals.

Monetization

Already at the stage of planning you should know how you will make money on your app because some monetization strategies will presuppose building additional functionality. When you are going to build a fintech app, you can consider one of the following options:

- In-app advertising;

- Subscription fees;

- Commissions for transactions;

- Premium features.

Of course, your choice of the way to make money on your app will greatly depend on the exact type of solution that you want to launch. But please, never forget about user experience. For example, if you want to introduce some paid features, it should be absolutely simple to pay for them. And if you want to introduce in-app ads, you should make sure that they are not too irritating.

Your development team

It is crucial to work with finance app developers who have strong practical skills and deep theoretical knowledge that are required for creating advanced solutions for the fintech industry. If you already have in-house professionals with the required qualifications, then you will just need to make sure that the size of your team will be enough to perform all the set tasks. But if you do not have such professionals, you will need to work with freelancers or a reliable software development company. It will be useful for you to read some tips on how to find an app developer for your project. And you should also know that at Anadea, we have relevant experience and will be always happy to support you at any step of the development process.

Usually, a fintech apps development team has the following composition:

- 1 backend developer;

- 1 or 2 mobile developers (iOS and Android);

- 1 UI/UX designer;

- 1 QA engineer;

- 1 project manager.

However, your project team may look different based on the peculiarities of your future solution.

UI/UX design

We’d like to pay special attention to the necessity to think about the user-friendliness of your application and the way people will interact with its functionality. With such solutions, people will manage their finances and conduct various operations with their money. That’s why it is vital to make all processes as straightforward and clear as possible. The complicated logic of your app will pose additional risks of losing money by mistake or conducting wrong operations. And without any doubt, such threats will discourage users from choosing your application.

Regulatory compliance

The banking and finance industry is one of the most regulated ones. To operate a fintech mobile app, your company should have all the required licenses and permissions (their list will depend on the chosen jurisdiction). Without obtaining such approvals from the relevant authorities you can’t offer any finance-related services. And here, you should be very attentive. You need to study the existing requirements, rules, and regulations already at the stage of fintech application development in order to build a solution in accordance with them. Moreover, you should check whether the services that you are going to offer are allowed in the chosen region. This point is especially important if you want to provide any services related to cryptocurrencies.

Fintech mobile app development challenges

When you are looking for tips on how to develop a fintech app, it will be very helpful to analyze potential challenges that you can face at any stage of project realization. When you are well-prepared for them, you will be able to easily mitigate any possible risks.

- Right targeting. Already at the stage of planning, you need to clearly define who will be your target audience and what tasks you will help them to fulfill. Let’s admit that when, for example, you want to build a solution for investing in stocks, students or teenagers won’t be the right audience. That’s why you should always know who, how, and when will use your software.

- Appropriate tech stack. We always recommend customers choose rather popular and widely used technologies. Otherwise, it will be difficult for them to find developers who will be able to support their solution, enrich it with new features, and make the desired integrations. Moreover, the selected tech stack will greatly depend on the type of application (a native, cross-platform, or hybrid app) that you are going to create. The wrongly chosen technologies may become an obstacle to your app’s growth, enhancement, and user base expansion.

- Security. Fintech apps deal with a lot of sensitive data and have access to users’ funds. That’s why fintech app developers should always focus on the necessity to introduce strong tools and measures that will help to protect their solutions from different types of external attacks.

How to build a fintech app: Key features

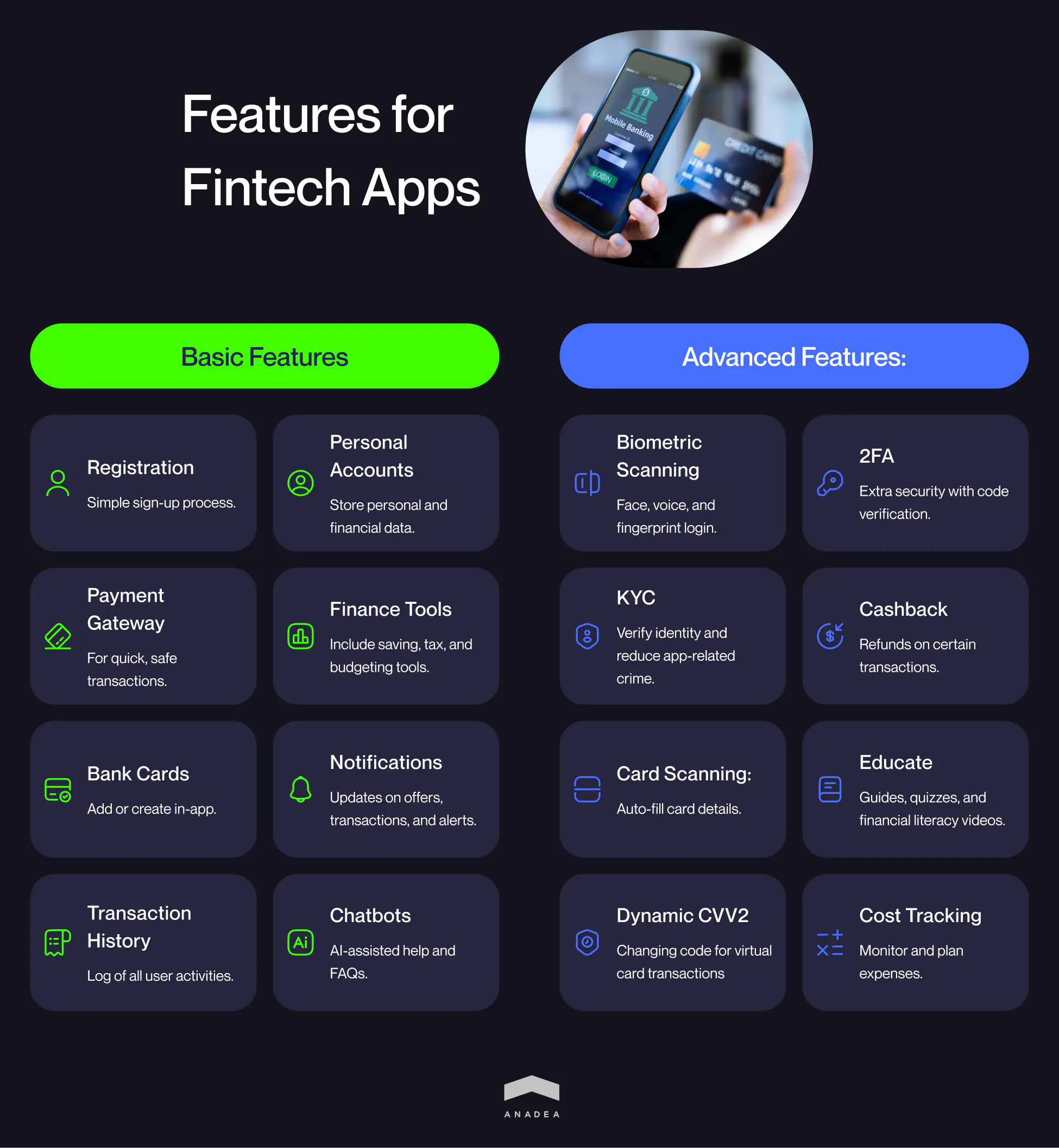

You will create an exact set of features for your solution after you define the goals of your project and its target audience. Moreover, you should be ready for the situation when already after the launch of your app, you may realize that to achieve higher user satisfaction you need to introduce new tools. Below you can find a list of features that you may use for building your application.

Must-have features for fintech apps:

- Registration. The process of signing up should be simple and clear, otherwise, you will risk losing users already at this step.

- Personal accounts. This section will store the personal and financial details of users.

- Payment gateway. You need to provide functionality for quick and safe transactions.

- Personal finance management. This group of features may include tools for saving, tax planning, and budgeting.

- Bank cards. Users should be able to add their existing bank cards or create them directly on the app.

- Push notifications. This feature can be used to notify users about special offers, new products, services, and important changes in your company’s policy. Moreover, via notifications users can be informed about incoming transactions as well as the necessity to complete failed operations.

- Transaction history. Users should have access to the history of all their transactions conducted via your app.

- Chatbots. AI-powered chatbots can be used to get answers to questions related to the interaction with your app, your products, and your services.

Advanced features for fintech apps:

- Biometric scanning. You can increase the protection of your app by introducing tools for facial, voice, and fingerprint recognition instead of traditional passwords.

- Two-factor authentication. 2FA features that will require providing codes received via phone calls or SMS are also expected to guarantee a higher level of security.

- KYC. Such features as identity verification, customer identification, transaction monitoring, and risk scoring will help to reduce the level of criminal activity on the app and ensure regulatory compliance.

- Cashback. Let users enjoy refunds of some percentage of the amount spent via your app.

- Card scanning. This AI-powered feature will help eliminate the necessity to enter card details (such as cardholder name, expiry date, or card number) manually.

- Education features. You can enrich your solution with various guides, quizzes, and videos that will help users better understand the principles of financial literacy.

- Dynamic CVV2. This feature is highly important for virtual cards. This tool will let users get a changing CVV code each time they need to make a transaction.

- Cost tracking. With this functionality, users will be able to better monitor their expenses and plan their budgets.

Latest trends in financial mobile app development

To make sure that your fintech mobile app will get excellent chances to succeed in the market, it is important to build it in accordance with the ongoing market trends. And this principle works not only in situations related to its design but also its functionality.

The fintech landscape is a quickly evolving one. That’s why it is necessary to continuously track all the changes in order to stay tuned. At the moment we can observe the increasing demand for the following cutting-edge functionality.

- AI. It is one of the core technologies used in mobile app development for fintech firms. Chatbots, scanning features (image-to-text), voice recognition, as well as AI-powered predictions and personalization are among the most promising tools for fintech apps of the latest generation.

- Open banking. This concept presupposes letting financial service providers get access to the financial data of users across various financial institutions after getting users’ consent. The process of accessing this data is possible thanks to APIs. It is expected that open banking will help to boost customization, transparency, and automation within the financial industry and will help users to better manage their financial data.

- Embedded finance. This approach is based on the idea of integrating financial services like loan processing or payments into non-financial solutions (social media apps, e-commerce platforms, etc.) without redirecting to traditional financial applications. One of the most obvious benefits of this approach is a seamless payment process.

Final word

Fintech apps are believed to be the future of the financial industry. Though at the moment they can’t fully replace traditional financial processes, they can greatly complement them by making financial products and services available to a wider audience. Users demonstrate a strong interest in such applications. And it can be viewed as a sign that today is just an appropriate time for finance mobile app development projects.

If you want to find out how to build a fintech app or you are already ready to proceed to the development stage, do not hesitate to contact us! Our team will deeply study your case and will offer the most feasible solution. With our expertise in this sphere, we are sure that we can cope with tasks of any complexity.

Have questions?

- Fintech app development cost depends on numerous factors, including the type of application, the complexity of the desired functionality, and the number of required integrations. One more important parameter that should be taken into account is the rates of finance app developers who will work on the creation of your solution. Usually, finance mobile app development starts at $80.000, and it may take 20-25 weeks to deliver a final solution.

- There are several options for those who do not have in-house specialists. You can either hire freelancers or work with a professional software development company like Anadea. Though the first variant can be cheaper, with the second one, you are better protected from various risks as you always sign a contract and an NDA with your vendor. Moreover, when you work with a software development company, a lot of administrative and organizational questions will be the responsibility of the hired team and you will be able to focus on your core business activities.

Don't want to miss anything?

Subscribe and get stories like these right into your inbox.

Keep reading

How to create an investment app: Guide 2025

Planning to launch an investment application? It can be a very promising idea in 2025. Read our investment app development guide to launch a successful product.

How to Build a Mobile Banking App: Key Tips

If you are thinking about developing a mobile banking application, read our blog post where we will share a row of essential recommendations.

Loan App Development: Practical Recommendations

Loan lending apps boast high popularity! Read our blog post to find out how to create a money lending app that will be able to rock the market.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.