Custom Insurance Software Solutions

At Anadea, our mission is to help you become a leader in your industry, whether it's medicine, real estate, auto insurance, logistics, manufacturing, or travel. We specialize in developing custom web and mobile apps that are designed to meet your specific business needs. Our team is dedicated to delivering impressive design and seamlessly integrating custom insurance software with third-party services. We offer migration services, ongoing support, and the ability to extend existing solutions, making it easy for you to scale your business and take it to new heights. If you're looking to gain a competitive edge in your industry, turn to Anadea for comprehensive solutions that deliver real results.

Frequent insurance software

requests from our customers

Entrust automation and digitization of your most important business processes to a trustful insurance software development company Anadea.

With the custom solutions, you’ll observe a rise in client acquisition, sales, reduction of time for routine operations, and growth of accuracy and controllability for complex project tasks.

-

Automated signing

-

GPS tracking

-

Online payments

-

Claims management feature

-

Chatbots

-

Data analytics

-

Apps for agents

-

Enterprise software

-

Anadea’s expertise in insurance software development

-

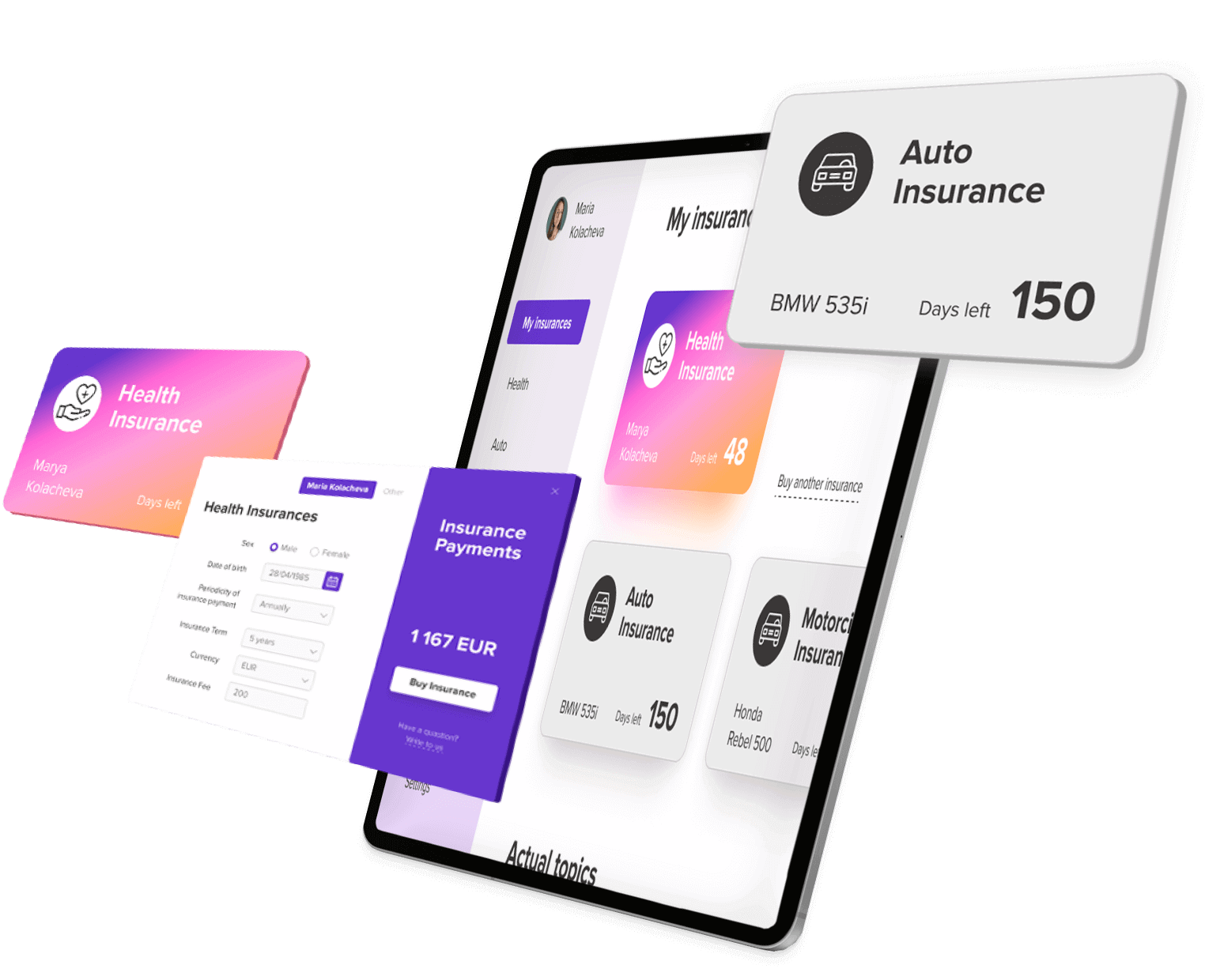

Web development

Anadea has 20-year expertise in custom insurance software development services. We created insurance solutions for the medical sphere, real estate, auto insurance, logistics, manufacture, travel, and other industries.

-

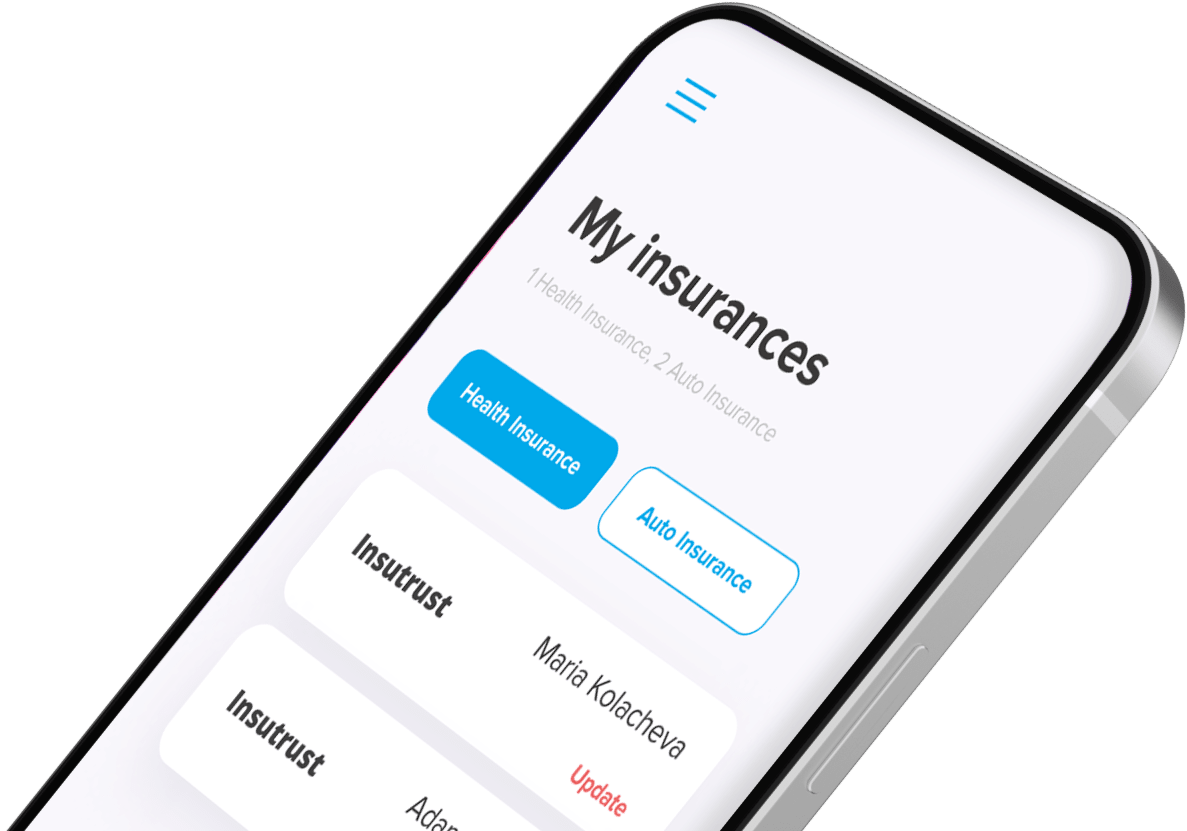

Mobile applications

At Anadea, we deliver best-in-class mobile solutions for agents who work outside the office. With everything needed at hand, they proceed to perform everyday tasks productively.

-

Legacy systems upgrade and migration

We can breathe life into out-of-date software by getting rid of technical debt, rebuilding architecture, optimizing code, and working on performance. It can be done by implementing modules one after another, not disrupting the business processes.

-

Enterprise solutions

Anadea among other top-rated insurance software vendors suggests custom development of Enterprise Risk Management (ERM) Software, Compliance Management, Document Management systems, and many other enterprise solutions for streamlining your business processes.

-

Custom integrations

We help with API integrations of various service providers to ensure the convenience of use of your favorite services together with custom-made solutions and get a synergy effect of them along with saving time between switching and transferring information from one system to another.

Featured projects for insurance

Insurance Calculator

An online tool for US citizens to make smarter choices in their health care insurance decisions by calculating data received from GoodRx API and data from a database.

Anadea’s competence in insurance software development

- Policy administration solution

- Insurance agency management software

- Apps for agents/Agent commission calculation

- Website for Insurance agency/Online portals

- Chatbots

- Claims management solutions

- Risk Management Software (ERM)

- Insurance data analytics solutions

- Enterprise solutions

- Insurance carrier software

How Anadea uses AI and ML features for insurance sphere

Artificial Intelligence and Machine Learning in the Insurance Industry streamline routine tasks, help employees to make decisions, and process information. Here are some use cases of AI and ML for the Insurance Sector.

-

Lead management

Lead management accumulates lots of data. AI can assist in lead validation, finding more lead’s information, renew it with time, adjust recommendations according to purchase history, potential spending, and make predictions to provide better cross - and up sale. In the call centers, AI distributes the flow of calls or solving simple typical tasks for customers.

-

Information input management

When the number of insurance applications increases, it is necessary to hire more personnel, equip new workplaces, and expand office capacities to process them. The costs for this are significant and ineffective since the productivity of manual input is low. Automated systems can significantly increase productivity, the efficiency of processing client applications of insurance companies, and reduce costs.

-

Using AI

Using AI, make the process for one operator more efficient in 3-5 times per day. With processes such as input recognition, routing, and clustering, it is possible for insurance companies to avoid manual data handling and data management. Efficient input handling will automate the routing of issues to the right solution provider within an insurance company.

-

Claims management

Artificial intelligence in the insurance industry has redesigned the claims management process, making it faster, better, and with fewer errors. Insurers now have the ability to achieve much better claims management using technology by facilitating first-time applications and preliminary assessment of claims when automating the damage assessment process, as well as automated fraud detection with data analytics.

Testimonials

Still in search of insurance software companies?

Leave the request for your project estimation and Anadea insurance software developers will help you with the rest.

Check This Out

In our blog, we talk about the ins and outs of custom software development, tips on establishing efficient collaboration with IT services providers, challenges and opportunities of the digital transformation, innovative technologies, and trends shaping the future of the business world.