Flexidea

Invoice

Financing

Platform

Flexidea is an invoice financing solution that aims to transform the landscape of invoice factoring. The project leverages fintech app development and artificial intelligence to offer a seamless, efficient, and user-friendly platform for businesses and individuals seeking a modern alternative to traditional factoring.

Financed

€68M+ in invoices

Invoice funding

within 24h

Invoice auto-filling

AI-powered

Invoices per user

Unlimited

Story behind

The client, a Latvian entrepreneur, had the vision to simplify invoice funding. As the idea matured, the application began to take shape. By the time a partnership with Anadea was established, the Client and Debtor parts of the platform had been already completed.

Anadea was then tasked with developing the Service part of the application for Flexidea representatives, as well as creating advanced invoice processing functionality powered by Artificial Intelligence (AI) and Machine Learning (ML).

Flexidea's innovative approach didn't go unnoticed. The European Union saw its potential and provided financial support through the Programme for Employment and Social Innovation (EaSI).

In addition, Flexidea received further backing from the EU's InvestEU Fund.

How it works

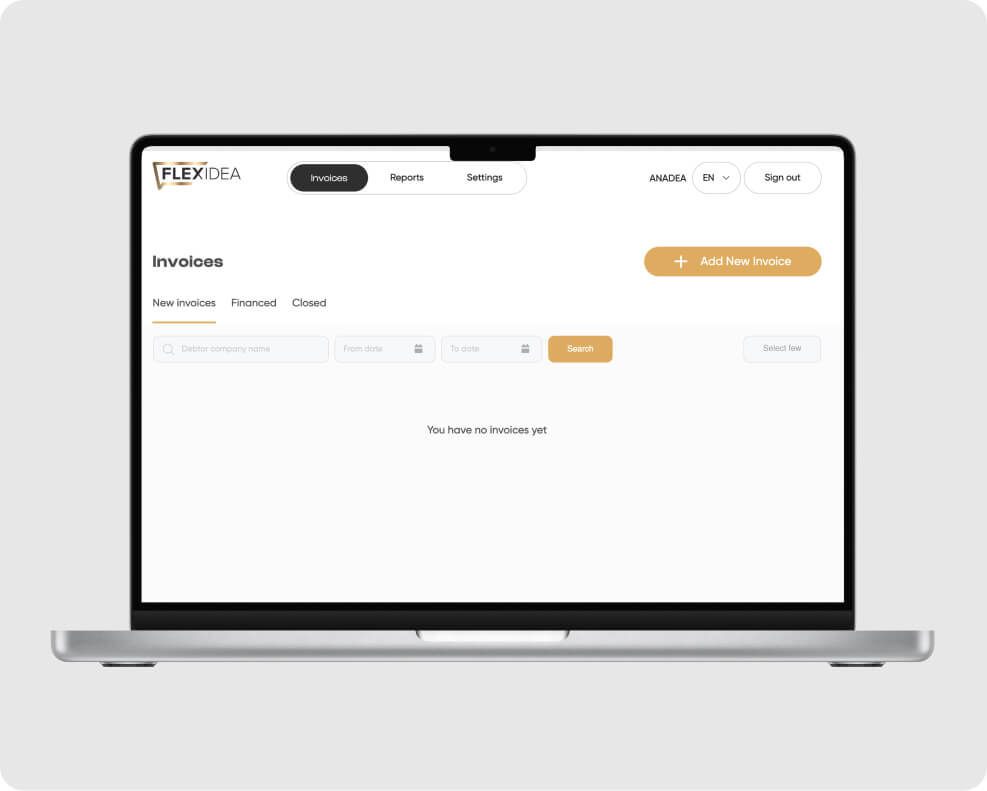

A factoring application, Flexidea offers businesses and individuals financial transactions that allow them to improve their cash flow.

This process involves three roles – Client, Debtor, and Flexidea Service (Representative), each with its own set of features.

Client

-

Registers to the factoring app online.

-

Signs an agreement once using tools like e-signatures or Mobile-ID.

-

Uploads invoices and gets a funding decision within 15 minutes.

-

If approved, receives payment within 24 hours.

-

Encounters varied fees based on payment timing.

Debtor

-

Receives a link via email to confirm offers and invoices.

-

Confirms delivery and payment through the app.

-

The system auto-generates offers based on risk and credit limits.

-

Commissions are auto-calculated upon invoice approval.

Flexidea Service

-

Provides funding by financing client's invoices.

-

Sets client funding limits using a credit limit matrix.

-

Integrates with state services for current financial data.

-

Offers a grace period for investor loans and manages transactions via an accounting platform.

In a nutshell, the flow for Flexidea platform consumers can be presented as follows:

-

1

Delivery of goods or services

The user delivers goods or services to their customers and issues an invoice for these, similar to the first step in traditional factoring.

-

2

Online registration

The user registers online in the Flexidea portal, initiating the digital factoring process.

-

3

Signing the agreement

The user signs the agreement on the use remotely. This step replaces the traditional invoice sale to a factor.

-

4

Invoice upload

The user uploads the outstanding invoice to the Flexidea factoring app, effectively selling the invoice to Flexidea.

-

5

Immediate payment

Flexidea, acting as the factor, pays the user a large percentage of the invoice amount within 24 hours, significantly speeding up the traditional factoring process.

Features of the platform

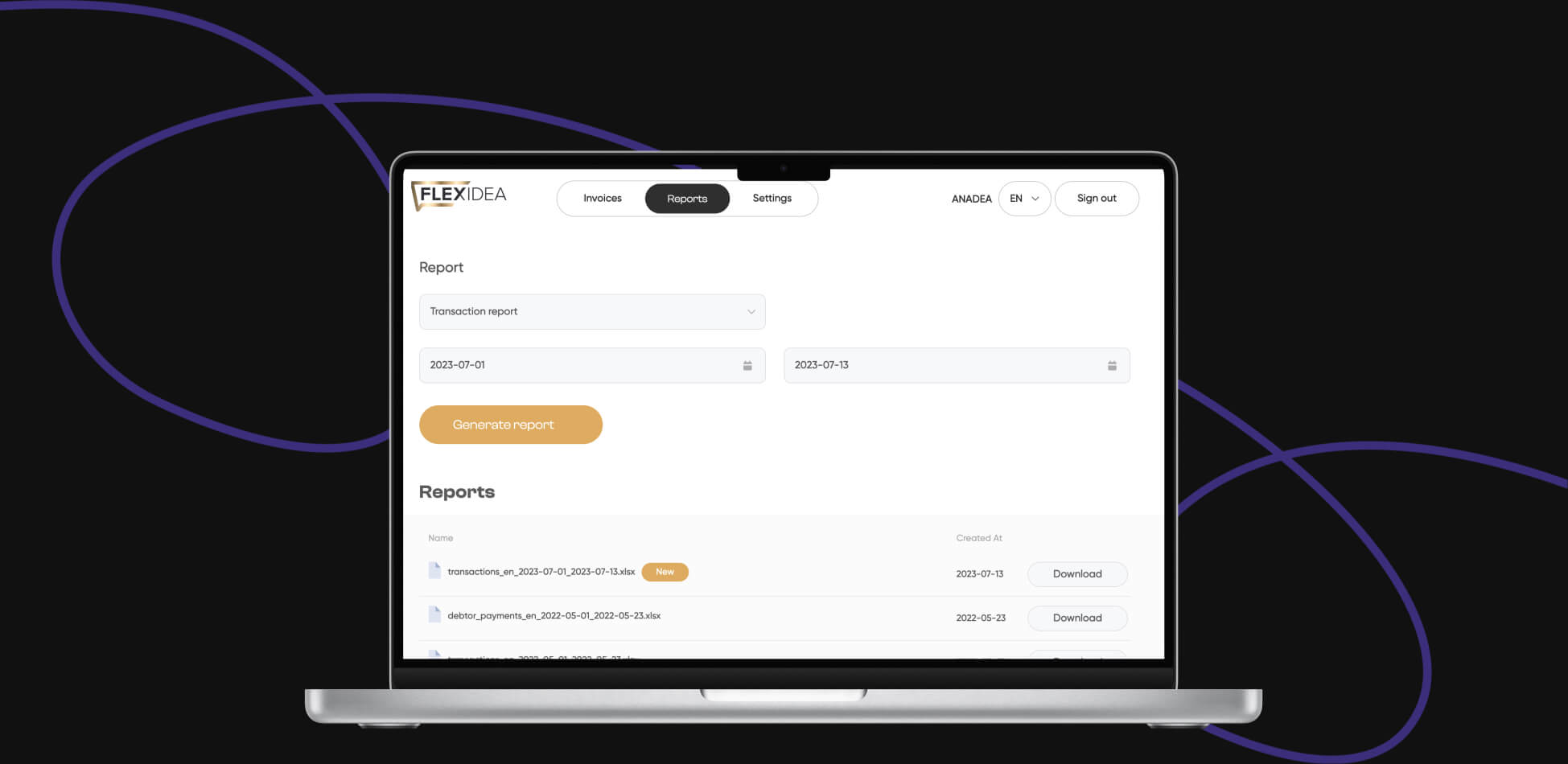

Anadea developed several key features within the Service part of the application designed for Flexidea representatives, those in charge of transaction management.

Auto-offering by required conditions

This feature allows Flexidea representatives to automatically offer financing based on predefined conditions such as concentration, risk level, and credit limit.

Credit limit matrix

A comprehensive matrix was developed to manage Client and Debtor credit limits, including income. This feature provides a clear overview of credit limits, facilitating better financial management.

Division limits for matrix and manual

This feature simplifies limit computation by taking the matrix into consideration, thereby streamlining the process and reducing the possibility of errors.

State service integration

The application integrates with the National Polish Bank for real-time exchange rate downloads and sanctions lists, ensuring accurate and up-to-date financial data.

Flexidea's investor loan grace period

Anadea developed a feature to manage the grace period for investor loans, providing additional flexibility for investors.

Accounting platform business transactions

This feature enables the seamless management of business transactions within the platform, ensuring accuracy and transparency.

Invoice recognition and auto-filling

Anadea’s Machine Learning engineers created an advanced ML model to auto-fill invoice details from documents uploaded to Flexidea servers.

AI-powered invoice auto-filling

Fintech platforms like Flexidea adopt AI not because it’s just a trend; it genuinely improves the user experience. Most people still find manual document handling tedious, after all. With this in mind, our ML engineers developed an efficient auto-fill model for invoices.

Flexidea acknowledged that:

- Traditional manual data entry is labor-intensive.

- The complexity of invoices increases the likelihood of human errors.

- Anadea’s Machine Learning engineers created an advanced ML model to auto-fill invoice details from documents uploaded to Flexidea servers.

We addressed these challenges using AI, having crafted a model that offers:

Efficient data input

With a straightforward process – users take a picture of their invoice and upload it – our invoice data extraction model gets to work.

Accurate data identification

Our advanced document understanding model discerns between the myriad of data fields, ensuring that an invoice number isn't mistakenly recognized as an account number and vice versa.

Simplicity & Speed

The end result? Fast, efficient, and error-free data input.

Special mention

The Latvian language model

One of the standout achievements of this solution was the development of a specialized model for the Latvian language. While AI models for widely-spoken languages are prevalent:

We identified a gap in the market for Latvian linguistic processing.

Developing a model for such a specific language required intensive data training and localization efforts.

Our success in this arena exemplifies our commitment to addressing diverse market needs, even when they're niche (like invoice financing software).

Challenges

Developing a complex invoice factoring application like Flexidea comes with a set of challenges.

Ensuring the security of financial transactions was paramount, requiring the implementation of robust security measures.

Integrating with various third-party services while maintaining a seamless user experience was another consideration. Additionally, the need to comply with financial regulations and standards added another layer of complexity to the project.

Making the AI component posed its own challenges. Initially, we based the tool on the available language models, but as it evolved, we delved deeper into enhancements. Despite varying document sizes and infrastructure challenges, we achieved consistent and efficient prediction speeds.

By incorporating feedback from both model outputs and user modifications, we made significant refinements to Flexidea’s invoice auto-filling model. Even complexities like handling documents in multiple languages or processing poor-quality inputs have been addressed, enhancing our system's performance.

Results for the client

Flexidea has made a notable mark since its launch: the platform has financed over 9,000 invoices and helped more than 250 clients, with a total invoice sum of over €68,000,000.

Now, as the client’s factoring application expands into the Polish market, it's clear that it’s both scalable and effective. Adding to this, Flexidea’s innovative invoice auto-filling AI has made things even easier for users. It's not just about using new tech.

It's not just about using new tech; it's about streamlining processes for everyone involved, making a real difference in the fintech world.

Now the company is looking forward to further innovations, reaching more markets, and continuously simplifying financial processes for clients globally.

Technology stack

Web landing page

Semantic UI

Hugo

SaaS

Web app

Spring MVC

Thymeleaf

Wro4J

Backend

Java 11

Spring boot

Spring security

JOOQ

Flyway

Backoffice

Java 11

Spring boot

Vaadin

JOOQ

Affiliate API

Spring boot

Spring security

Swagger

REST

Third-party integrations (LV)

SMS

Messente

Sendgrid, SMTP (gmail)

Notifications

Slack

File storage

Google Cloud Storage

Credit bureau

KIB LV and KIB EE

AML Verification

Ondato

Web chat

Tawk.to

Analytics

Google Tag Manager

P2З platform

Debitum

User session recording

FullStory

Third-party integrations (PL)

SMS

Messente

Sendgrid, SMTP (gmail)

Notifications

Slack

File storage

Google Cloud Storage

Credit bureau

BIG, CreditReport, PWG

AML Verification

Ondato

User session recording

FullStory

Web chat

Tawk.to

Analytics

Google Tag Manager

Currency Rate

National Bank of Poland

P2З platform

Debitum

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.

Featured projects

Explore more projects for the fintech industry. Businesses that benefit from Anadea’s financial software development offer clients robust tools to trade across various markets, lend money, and handle their investments efficiently.

-

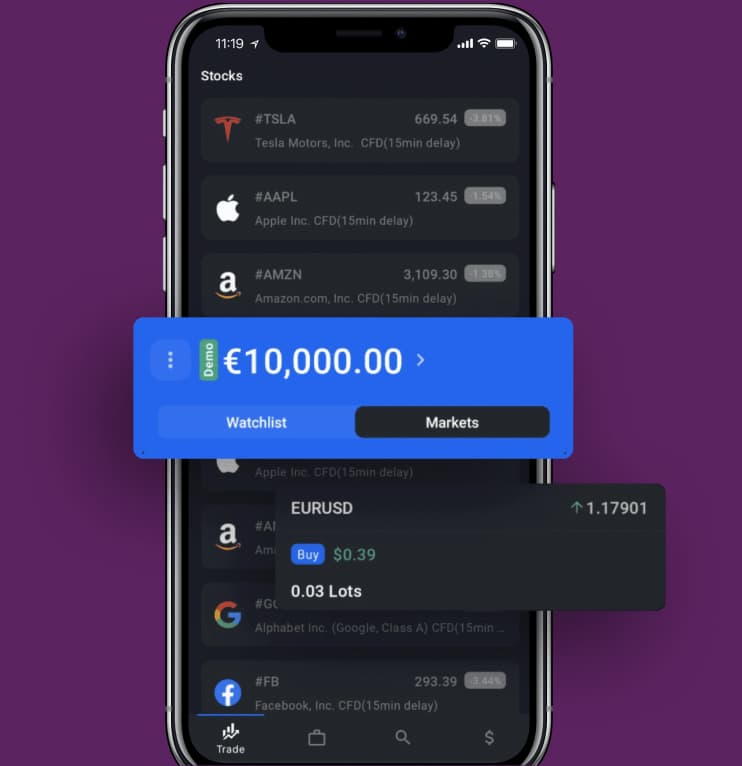

Admirals

A comprehensive personal finance center with a variety of spending, investing, and money management solutions.

-

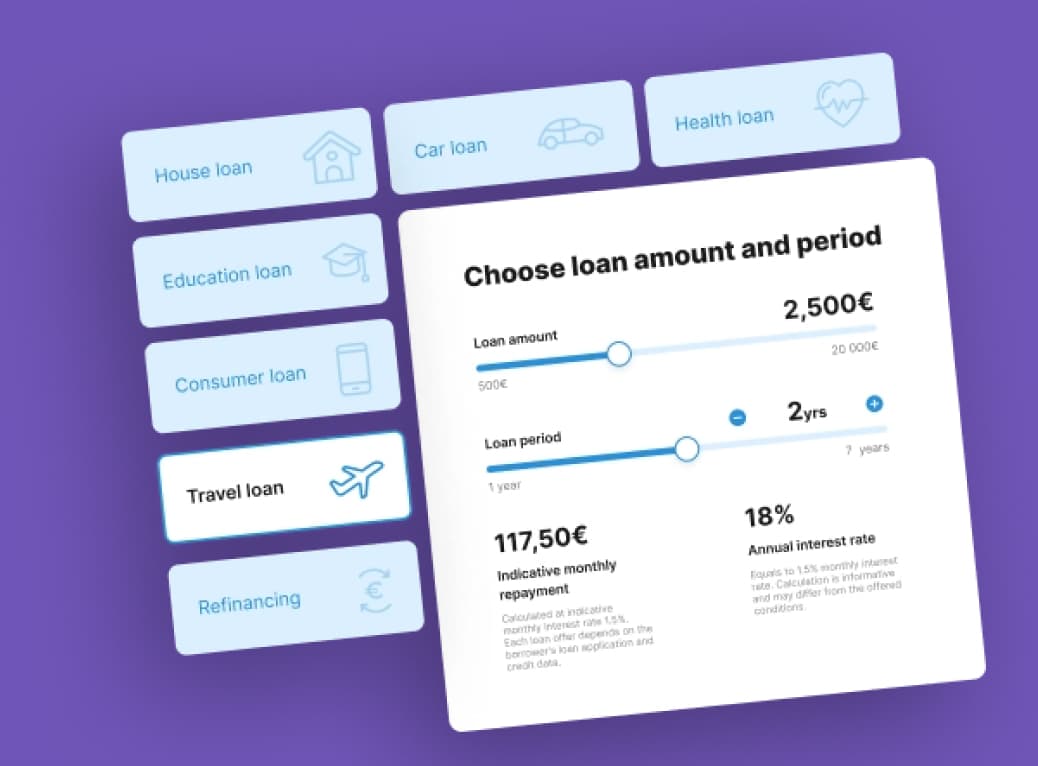

MONEYZEN

An Estonian peer-to-peer web platform for loans and investments based on the principles of responsible lending.