P2P Lending

Software Development

Peer-to-peer lending software is a powerful tool for earning interest on investments or borrowing at competitive rates. Whether you're launching a new P2P lending platform or improving an existing one, we provide perfect solutions for your needs.

We build P2P loan software for every need

P2P lending supports a wide range of loans by connecting borrowers with individual or group lenders. We develop financial tools for specific challenges on your demand.

-

Consumer loans

Direct lending for personal financial needs.

-

Business loans

Funding for small businesses from individual investors.

-

Education loans

Loans for students or parents from private lenders.

-

Real estate loans

Borrowing for property investments from private lenders.

-

Auto loans

Financing vehicle purchases through peer-to-peer lending.

-

Debt consolidation loans

Combining multiple debts into a single loan from various lenders.

-

Invoice financing loans

Businesses sell unpaid invoices to private investors for quick cash flow.

-

Green loans

Funding eco-friendly projects from environmentally conscious lenders.

Discover the possibilities

Whether you’re seeking end-to-end P2P loan software development or to expand the functionality of your application, we’re eager to assist you. Share your project details and get a personalized cost estimate.

Key services

We work with both new and established businesses, offering all from P2P lending software development from scratch to existing platform modernization.

Create a bespoke P2P lending platform designed to drive profitability.

Legacy migration/rewrite

Upgrade outdated systems with scalable, modern technology for better performance and security.

3rd-party integrations

Connect APIs of essential services like payment gateways, credit bureaus, and CRMs.

Use Machine Learning (ML) and Deep Learning (DL) to enhance decision-making, personalize user experiences, and improve risk management.

Features of peer-to-peer loans software

Our developers implement critical features for a smooth, efficient P2P lending experience.

User registration and authentication

Secure onboarding with email/SMS verification and social login options.

AML/KYC compliance

Automated Anti-Money Laundering (AML) and Know Your Customer (KYC) processes, integrating with third-party verification services.

Matching engine

AI-driven algorithms to connect borrowers and lenders based on preferences and risk profiles.

Loan origination

Automated workflows for applications, including real-time credit scoring and document verification.

Loan disbursement

Secure fund transfers with multi-signature wallets and ACH processing.

Customer support

AI-powered chatbots and multi-channel support for efficient query resolution.

Investment dashboard

Comprehensive overview of portfolio performance and projected returns.

Investment limits

Customizable limits based on risk tolerance and available funds.

Diversification tools

Intelligent suggestions for creating diversified loan portfolios.

Partial investments

Flexibility to invest smaller amounts across multiple loans.

Early repayment options

Reinvestment opportunities for early loan repayments.

Tax reporting

Simplified access to tax-related investment information.

Loan application form

Streamlined process with clear eligibility criteria.

Credit score assessment

Integrated evaluations for accurate scoring.

Loan offers

Multiple options from various lenders for borrowers to choose the best terms.

Loan acceptance

Secure process to finalize and accept the chosen loan offer.

Repayment calendar

Visual overview of repayment schedules and due dates.

Early repayment options

Flexibility to make early repayments and reduce interest costs.

Platform management

Centralized dashboard for monitoring platform performance and user metrics.

Risk management

Tools to assess borrower creditworthiness and manage loan defaults.

Pricing and fee management

Flexible settings for interest rates, fees, and commissions.

Marketing and promotion

Tools for managing campaigns, content, and social media engagement.

Investor relations

Effective communication management with investors.

Customer support management

Efficient handling of customer inquiries and support ticket tracking.

Users will love a P2P loan app packed with essential features and more.

Want to define the optimal set of features for your platform? Let’s explore the best options together.

AI features for P2P lending software

We professionally integrate P2P lending platforms with Artificial Intelligence (AI), automating every aspect of lending and borrowing money.

-

Risk assessment and scoring

-

Automated decision-making

-

Predictive analysis

-

Fraud detection

-

Portfolio management

-

Real-time monitoring

-

Customer interaction

-

Data-driven insights

-

Real-time loan approvals

-

Automated loan repayments

Excited to try AI and Machine

Learning in your fintech business?

Anadea’s experts are ready to help. Tell us what you have in mind, and we

will craft a bespoke strategy to integrate these technologies seamlessly

into your operations.

Related projects, powered by AI

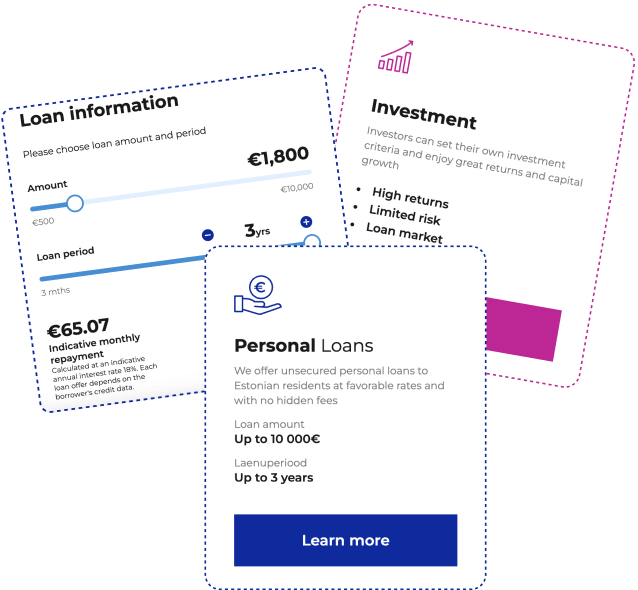

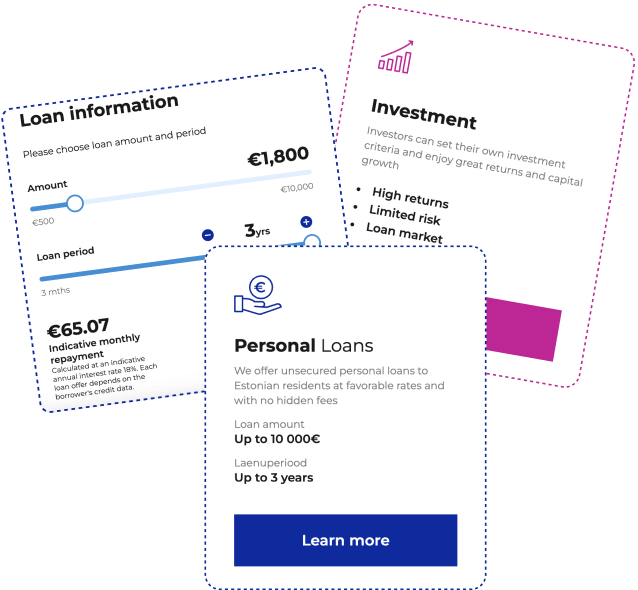

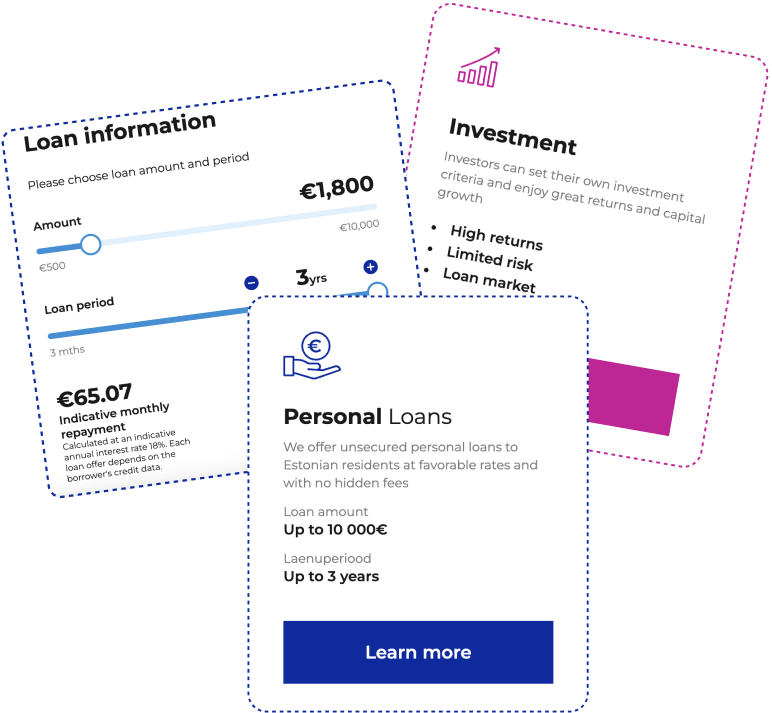

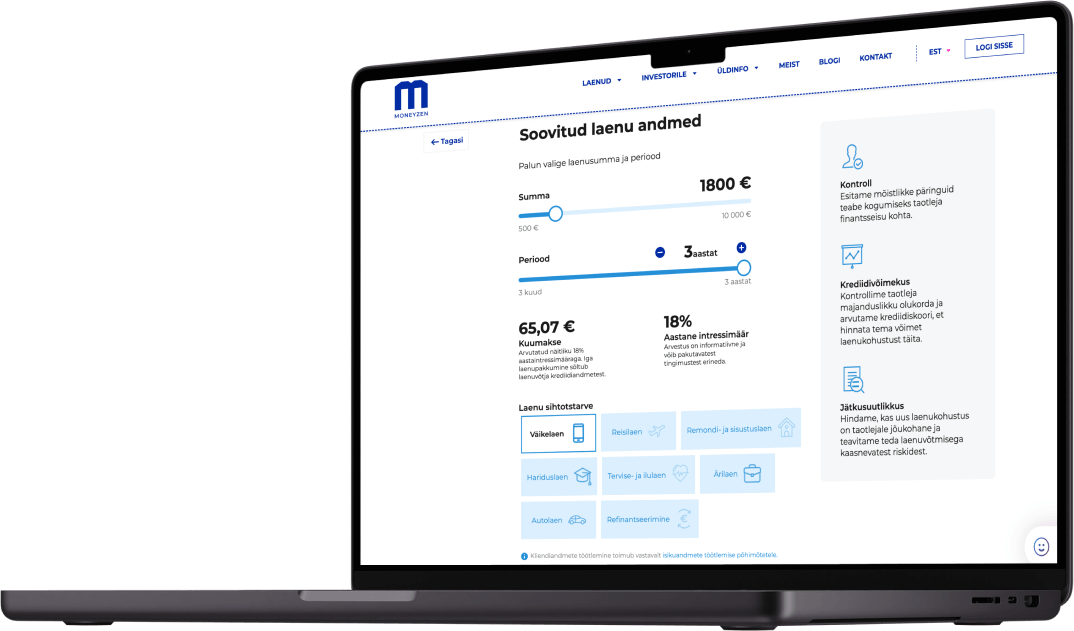

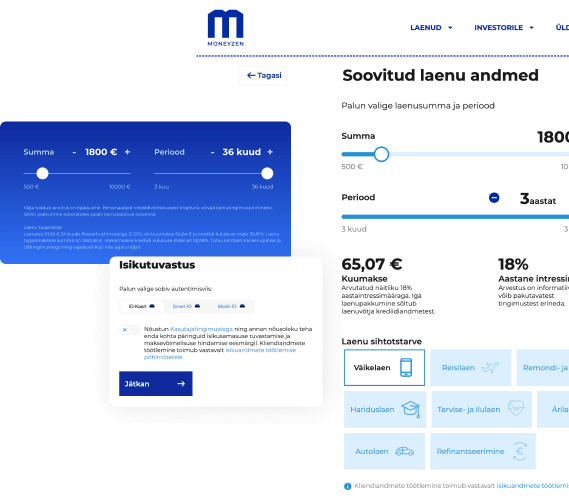

MONEYZEN

A P2P platform that includes cash flow forecasting by portfolio, providing dynamic income projections based on market trends, enhancing financial planning and investment management.

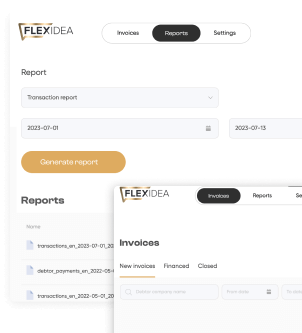

Flexidea

A factoring app powered by a machine learning model that auto-fills invoice details from uploaded documents, accurately distinguishing between data fields like invoice and account numbers, ensuring precision and efficiency.

Key integrations

We master integrations with third-party systems, ensuring smooth operations and enhanced functionality. Not sure which integrations to use? Our P2P lending software development experts can help you find the perfect solutions.

Security is our focus

In digital finance, security is top priority. We make sure peer-to-peer loan servicing software is fortified with cutting-edge measures to protect data and prevent breaches.

-

Authentication with FaceID/TouchID/PIN that reduces reliance on traditional passwords, enhancing both security and user experience.

-

Multi-factor authentication

Incorporating Time-based One-Time Passwords (TOTP) and biometric verification adds a layer of security, safeguarding user accounts against unauthorized access.

-

Security audits & penetration testing

Regular security audits and penetration testing ensure that the platform remains resilient against emerging threats, with vulnerabilities identified and addressed promptly.

-

End-to-end encryption

AES-256 encryption secures all data in transit and at rest, protecting sensitive information from unauthorized access.

Why us

4.9

Clutch rating97%

of customers

100%

of developers600+

projectsHave questions?

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.