MONEYZEN

The Admiral Markets Platform

AI-enabled peer-to-peer web platform for loans and investments based on the principles of responsible lending.

A story behind

MONEYZEN is a financial portal from Estonia that allows its users to register as an investor or as a borrower. Investors, on the one part, decide under which conditions they want to lend a loan, and borrowers, on the other, specify the lending period and amount of money needed.

The client came to Anadea with a legacy backend, a need for a modern user-friendly design, a request to simplify interaction with the platform for both parties, and a desire to attract more users willing to invest and borrow through MONEYZEN.

Anadea’s work on MONEYZEN

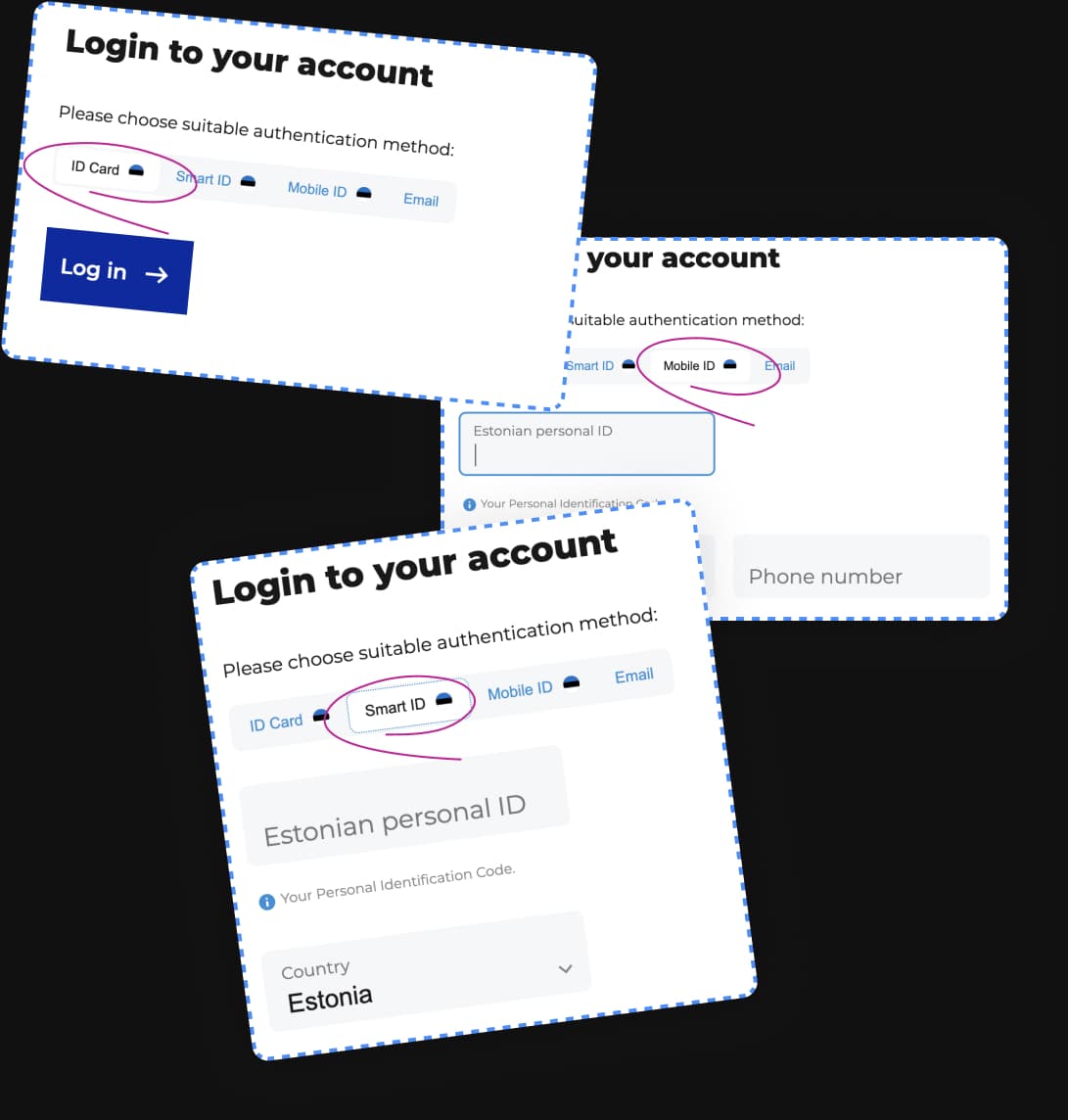

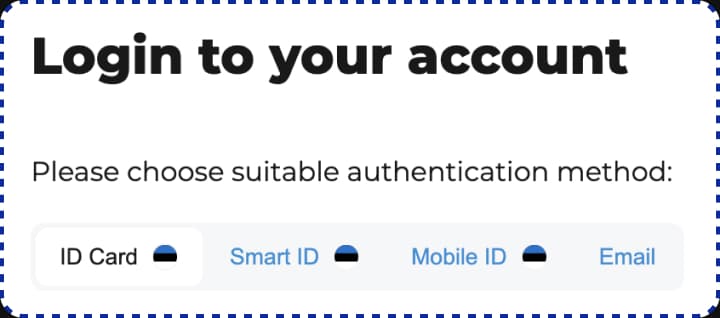

The project struggled with a lack of borrowers who completed a complex registration that suggested filling out multiple forms. The Anadea team integrated the client’s legacy with Estonian governmental services to automate registration as a borrower. Now to sign up, borrowers only need to specify their national ID, and the rest is auto-filled.

Multiple integrations with governmental services require keeping the platform up with frequently changing Estonian legislation, so our team is working on MONEYZEN’s consistency with relevant regulations in the field of finance. Apart from that, we redesigned the investors’ interface and improved the display of statistics in the admin panel.

Main features

Both investors and borrowers sign up using Email, Smart-ID 🇪🇪, or Mobile-ID 🇪🇪 and transfer money between their personal bank accounts and MONEYZEN virtual accounts.

For Investors

-

Creating and setting up an investment portfolio specifying terms: loan type, borrowers’ credit scores, loan period, and interest rate. Based on these criteria, the MONEYZEN algorithm suggests the investor to relevant loan applicants

-

5 credit scores of borrowers from high to low risk based on their ability to fulfill their obligations

-

Investing on behalf of either an individual or legal body - verification of the latter is required

-

Opportunity to sell investments to other investors in the MONEYZEN platform

For Borrowers

-

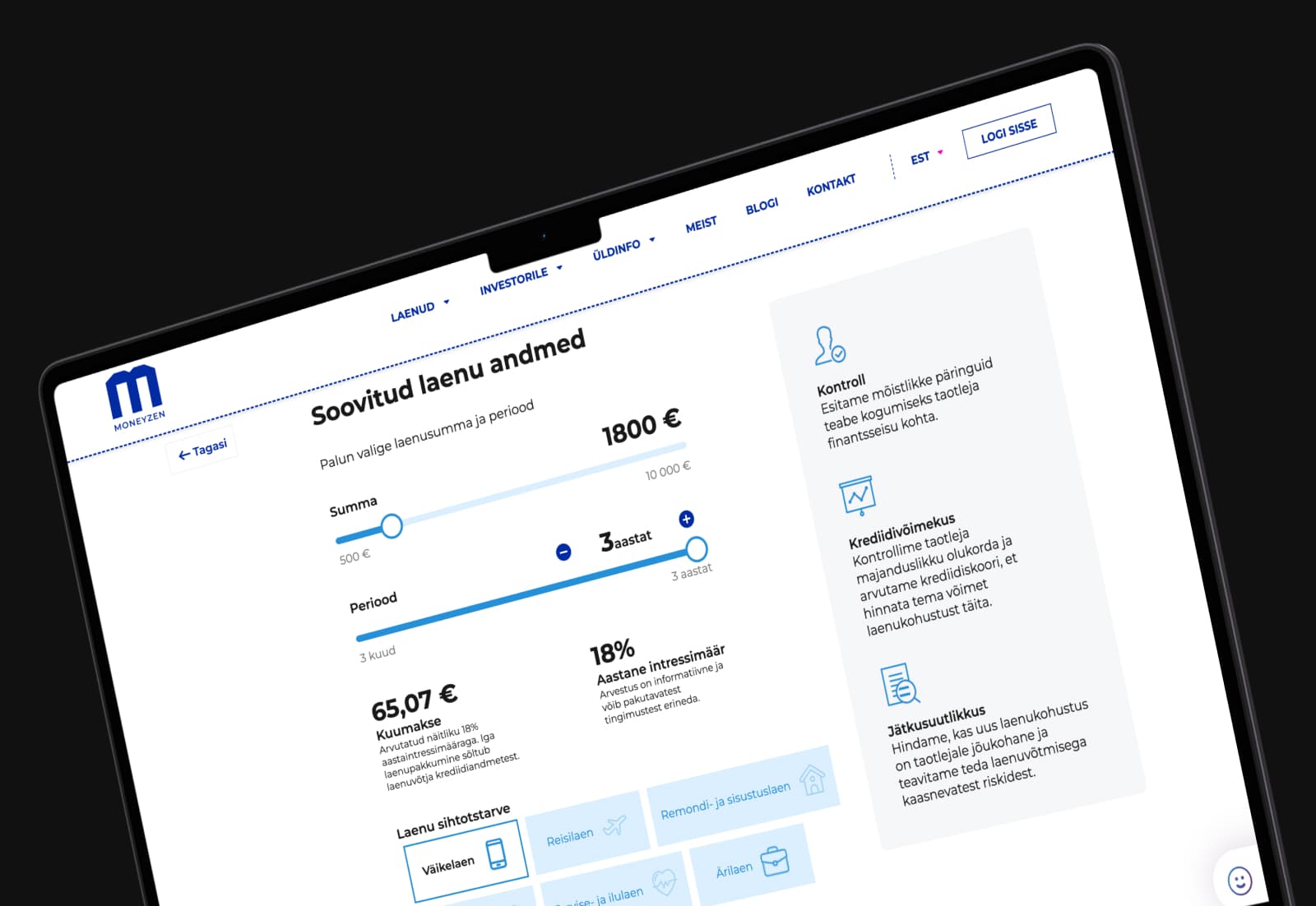

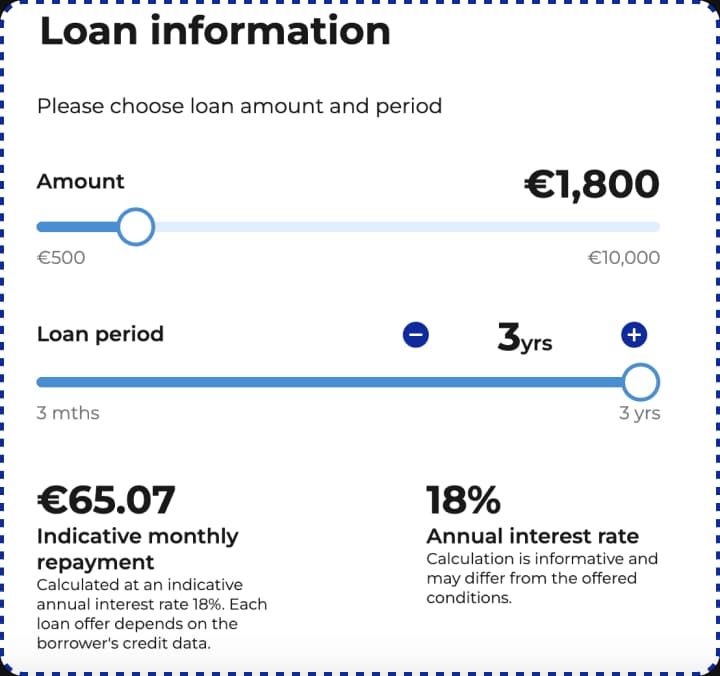

Applying for a personal loan of 500–10 000€

-

Accepting loan offers, concluding loan agreement, and e-signing it via Mobile-ID / Smart-ID / ID Card

-

Payment schedule

-

The opportunity for premature repayment

-

Interest-only period - temporary postponement of repayment when the interest is still charged

More opportunities

-

Thanks to the integration with governmental services, borrowers’ creditworthiness is automatically verified upon their registration

-

Interactive calculator for indicative monthly repayment and annual interest rate

Interactive calculator for indicative monthly repayment and annual interest rate -

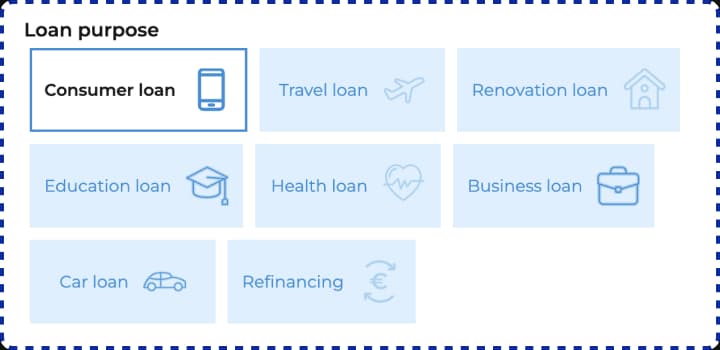

Various personal loan types: home, education, car, travel, consumer loans, and refinancing

Post-release improvements

-

AI-powered cash flow forecasting

MONEYZEN now empowers investors with cash flow forecasting by portfolio. This innovative feature takes into account the market state, providing dynamic projections of future income streams within their investments, ultimately enhancing users’ financial planning and investment management strategies.

-

Security enhancements

Financial platforms face online threats like DDoS attacks and fraud. We focused on enhancing the platform’s security with:

- A firewall filtering harmful traffic and protecting against DDoS attacks

- Secure microservices architecture for enhanced protection

- IP table configuration for granular access control

Additionally, we implemented a new secure method of authentication leveraging physical ID cards, coupled with a custom OCSP responder for document validity verification, which required integration with governmental services.

-

Marketing

Post-release marketing focused on user experience and efficient management. Anadea’s team prioritized:

- Streamlining user experience for smoother interaction

- Efficient affiliate marketing with accurate user data collection through S2S integrations

-

Development workflow enhancements

- Our team created a maintenance mode using static pages in Nginx, ensuring smoother and risk-free releases.

- We introduced a continuous integration pipeline (CI/CD) on GitLab that streamlines the development process, allowing for faster and more reliable updates.

Services

-

Back-end development

-

Marketing

Technologies

Integrations

-

With the banks

Baltic Gateway , LHV

-

User verification and e-sign in

Mobile-ID, Smart-ID, ID-card

-

Verification of creditworthines

Creditinfo Eesti AS, Krediidiregister, Accountscoring

-

Collecting & auditing data on borrowers

National Register

Future milestones

Now that our team has revitalized the project with AI and security enhancements, more users are joining MONEYZEN. The platform is monetized through commission for transactions, so more users mean more revenue! We helped the client fulfill their goals and can’t wait for more people to hear from MONEYZEN.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.