Balancing Legacy and Innovation: MONEYZEN’s Leading the Way in Responsible Lending

In this interview, we chat with Tõnis Mänd, CEO of MONEYZEN, a peer-to-peer lending and investment platform from Estonia. Since 2022, Tõnis has been steering the company through some big changes, including modernizing the platform and simplifying user interactions.

Tõnis shares his journey as CEO, highlights the unique features of MONEYZEN’s lending model, and underscores the value of strong partnerships. But in an increasingly competitive market, what is it that sets MONEYZEN apart in a highly competitive market?

Joining the company as a CEO

You’ve been CEO of MONEYZEN for more than two years now. Could you tell us about your professional background and what led you to join the company?

I’ve been in the finance industry for about 14 years, primarily working in the hire purchase sector with a focus on consumer lending through retail stores. Over the years, I’ve helped build two different companies in this space. In my first role, I began as a project manager and eventually became the head of the segment. After 5 years, I left to join another financial services provider, where I was responsible for establishing their operations in Estonia and then expanding into other Baltic countries. Eventually, MONEYZEN approached me with the opportunity to join their team.

How’s it been at MONEYZEN so far?

It has been quite an interesting journey over these two years. When I joined MONEYZEN, it wasn't a new company—it had already been in the market for nine years. But at the same time, the situation we were in made it feel like we were at the starting point, even though we had a lot of legacy to deal with. There’s been a lot of rebuilding, changes in strategy, and so on. Over these two years, we've developed quite a lot across almost all segments of the company. This sector of the lending business is slightly different from what I’ve been working on prior, so the investment segment really interesting.

What makes MONEYZEN lending different

What’s unique about this business?

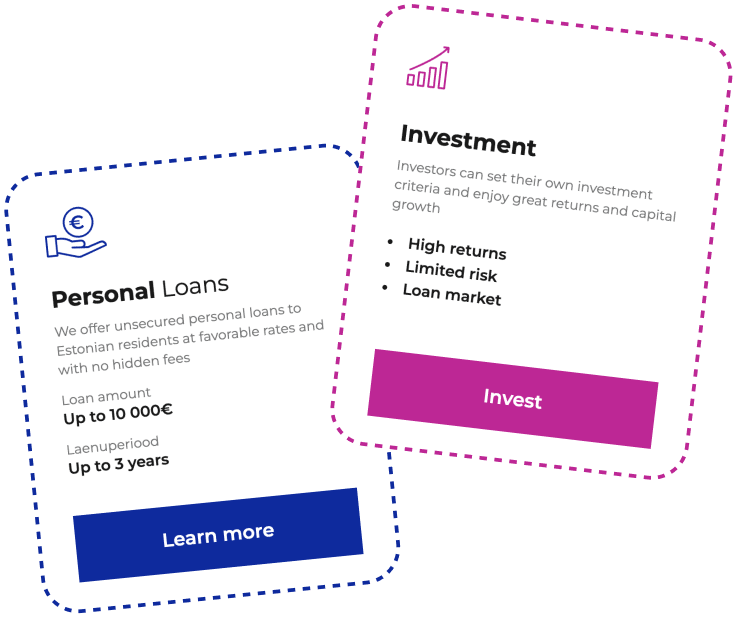

We’re a crowdfunding company, so we always need to grow both our lending and investor segments at the same pace. Essentially, we provide a platform where people can start investing in consumer loans. When you look at big finance companies, they get their funding from deposits, and most of the profit from each loan goes to the lending company. In our case, with crowdfunding, 74% of the earnings from each loan go to the investor, and we take the remaining 26%.

On advertising financial services

How do you advertise MONEYZEN to investors?

We use several different channels—affiliate marketing, direct marketing, online ads, outdoor ads, and, of course, influencers are becoming really important as well.

And which one has been the most effective?

Each one works on a different level. We’ve just started using influencers more actively, but in Estonia, the market is quite competitive. Ten years ago, crowdfunding was unique, and it was a great time to stand out in the market. Back then, investing was more complicated, and crowdfunding offered a simple entry point. Nowadays, investing has become easier, and there are many channels to choose from, even for as little as one euro. Crowdfunding has lost some of its edge, but we’re still competitive. Of course, higher returns come with higher risks, as with any investment.

Coming back to your question about what works best—we’re currently focusing on expanding outside of Estonia. For these new markets, as a small company with limited resources, affiliates are proving to be the most effective. Affiliates give us better market expertise compared to jumping straight into online or offline marketing without enough local knowledge. By using affiliates, we connect with potential customers and investors who are already looking for information and know where to find it.

Partnership with Anadea

Let’s talk about technology, specifically your collaboration with Anadea. How has that partnership contributed to your management?

MONEYZEN has been partnering with Anadea for almost four years now. There were some tough moments, especially when I first joined. We had quite a bit of legacy code, and it wasn’t the easiest to work with. We were using Ruby on Rails, which isn’t as popular anymore, so finding the right people who were proficient in it was a challenge. It took some time to get things running smoothly, but now I can confidently say that everything is working well.

Our IT team is really good at what they do—they have strong knowledge of all the legacy issues, and they’re able to react quickly. Interestingly, even though we’ve reduced the size of the IT team significantly, we’re delivering more than before. At first, the synergy between MONEYZEN and Anadea wasn’t perfect, and both sides faced some challenges. But once we got the right team in place and everything started clicking, progress followed naturally. Now, the team feels a sense of responsibility. They don’t just see it as delivering something to a partner; they see it as their product. They want it to work and to improve in every way.

Tackling tech challenges together

So, what you’re saying is that sometimes a smaller, well-synced team can achieve more than a larger one?

I’d still be happy to have a larger team, but the most important thing is synergy. At the start, we lacked that. Everyone was doing something, but nothing was getting done because priorities kept changing. Once we got the teams working well together, all the pieces fell into place. It wasn’t just an issue on Anadea’s side—it was also on our side at MONEYZEN. But with the right team and synergy, things started to work. Now, I’m really happy with the team we have and how things are progressing. The biggest challenge remains dealing with the legacy systems, which take time to clean up, but we’re making steady progress.

It’s great to hear things are moving in the right direction! So, as I understand, not all the legacy issues have been resolved yet?

No, no, of course not. As a finance company, there are always things that need to be updated. It’s not like you can build a system, launch it, and then enjoy the results for the next five years. We constantly need to update things. When you’re making updates, you have to set priorities, which means it takes time. Some legacy issues might not seem important right now, while others are crucial, but we can’t address everything at once. Sometimes, one thing depends on another, so there’s no point in tackling certain issues before other changes are made.

Finance is a dynamic field

So, while the code and software are constantly evolving, has MONEYZEN’s business model changed over the last two years?

The core business model hasn’t changed much. Our focus is still on lending and attracting investors. However, how we execute the business has changed significantly. Software-wise, we’ve made a lot of updates. Marketing-wise, we’ve also implemented changes. Operational procedures—how we work and what we do—have evolved as well. While our main goals and direction have remained the same, the way we go about achieving them has shifted quite a bit.

How do you identify which areas need to be changed?

The main thing is to identify what’s most critical for achieving our goals. Based on that, we decide which issues need to be addressed first. There are a lot of things we can work on simultaneously. Sometimes, it’s just a matter of adjusting our approach, whether it’s in marketing or re-prioritizing tasks. Other times, it’s about refining our procedures to make everything run more smoothly.

Could you give an example of something that wasn’t working, where you identified a weak point, improved it, and now it’s running like clockwork?

Well, without going into too much detail, one area that’s seen big improvements is marketing. Sometimes, it’s just about having the right person in charge. We brought in a really good marketing manager, and things started moving. The same goes for team synergy—now we have great team leads on Anadea’s side, and we’ve removed the middleman, so communication flows directly. In terms of procedures, we’ve changed how we communicate with customers and which channels we use. These changes have made a noticeable difference and are delivering results.

Respect for all parties

It’s nice to hear that marketing is being recognized! Speaking of marketing, we noticed on your website that MONEYZEN is positioned as a responsible lending company. What does responsible lending mean to you?

To put simply, being a responsible lending company means making sure we’re providing services thoughtfully. It’s not just about growing sales at any cost. We don’t take the approach of issuing as many loans as possible and dealing with debt collection later. That’s not sustainable, and it leads to customers facing financial difficulties. Instead, we focus on issuing fewer loans but ensuring they are of higher quality. This way, we prioritize the well-being of both our customers and our long-term success.

So that’s the philosophy behind MONEYZEN. Is there more to it?

Yes, there’s also the investor side. We apply the same philosophy there. MONEYZEN is about finding a balance—ensuring that both sides can grow their funds while minimizing risks. When investors use MONEYZEN, they should feel comfortable knowing there are no hidden fees and that we are delivering the best quality loans and results. It’s not the typical crowdfunding approach of issuing loans and leaving most of the risk to the investor. We want our investors to trust that their money is being managed responsibly.

Why the new look?

I also noticed that MONEYZEN recently went through a redesign and slight rebranding. What does this reflect about the changes in the company?

At some point, we realized that the branding philosophy set by our previous owners more than 10 years ago no longer aligned with where we were. We didn’t have a consistent marketing language. Over time, there was no connection between the initial vision and what we were doing. The website, for example, didn’t feel cohesive. Our marketing messages, both online and offline, didn’t match the experience on the site or the services. Everything felt disjointed.

So, we decided to rebrand and simplify. We took the original idea, reworked it, and brought everything together under one consistent brand. We created a new brand book, and while we’re still refining some details, we now have a core concept that we stick to. We want to avoid making the same mistake of allowing small differences to pile up until we lose sight of the original goal.

So it’s all about consistency across platforms?

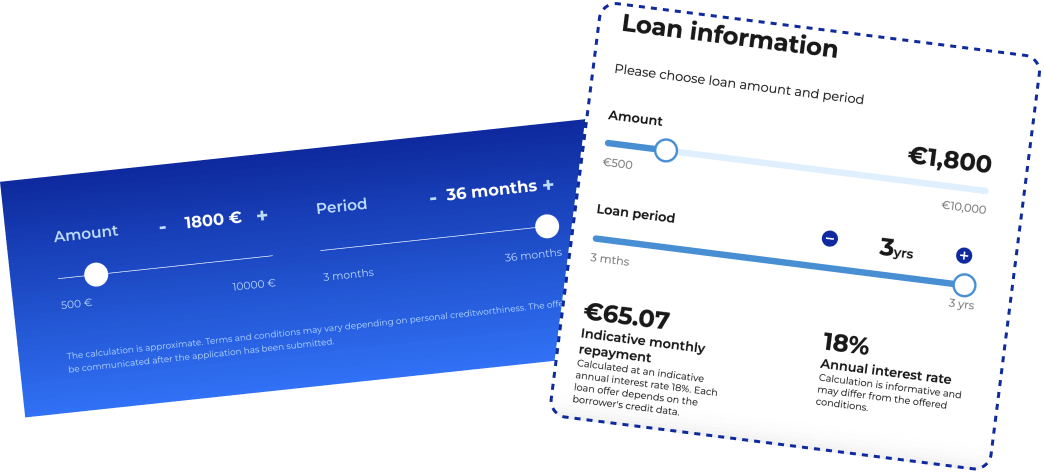

Exactly. Our old website felt like something from 10 years ago—it was outdated, even the colors. We recently participated in Estonia’s largest investment conference, and our new branding really stood out. The old branding would have just blended into the background. Another reason for the update was that, previously, our front page and system were integrated. Any changes had to be made by the development team, which took a lot of time. Now, we’ve split them up. We have the front page, which acts as a marketing tool, and then we have the self-service section where all the functionalities are. This allows us to use the front page more flexibly, like a landing page.

Tips for working with outsourcing partners

As a CEO, could you share any recommendations on how to effectively collaborate with outsourcing companies?

The key is to start by finding the right fintech software development company, and then setting up a strong team. Even with a great project, if the communication and teamwork between the companies aren’t good, things can go wrong. It’s crucial for the outsourcing partner to feel ownership of the project, not just see it as a task for another client. I’ve seen situations where a development partner completes the work, hands it over, and then the client realizes it doesn’t work as intended. It often comes down to communication—if the developers had felt a sense of ownership, they might have caught and addressed the issue earlier.

Another important factor is having the development partner actively involved in the project, helping to anticipate and address potential problems. From the business side, we can’t always foresee everything, especially when dealing with legacy systems. That’s where the IT partner comes in to provide technical insights and suggest the best solutions. Synergy, the feeling of ownership, and collaboration are the key factors for success in these partnerships.

If you were looking for an IT partner today, how would you approach it? How would you select the right company?

That’s a great question. Of course, recommendations are helpful if you’ve worked with someone before or have a reference from someone who’s done similar projects. It’s also important to look at what the company has done in the past and speak with clients who have worked with them. Additionally, you need to consider the specific sector. For example, in the finance sector, it’s important to choose a partner who has relevant experience. Even if they’re the best IT company in general, without sector-specific expertise, it can be more complicated. At some point, you also need to make a leap of faith.

What’s next for MONEYZEN

What are the short-term and long-term goals for MONEYZEN?

In the short term, we aim to strengthen our position in the Estonian market by growing both our investor and loan portfolios. We’re also looking to expand our investor base beyond Estonia. In the long term, we want to widen our product portfolio and consider expanding our loan business beyond Estonia as well.

And the last question—this one’s a bit unexpected. How would you describe your collaboration with Anadea in three words?

I’d start with “roller coaster” because it took time to get everything running smoothly. Then I’d say “synergy” and “partnership” to describe where we are now.

It seems like those three words capture the whole journey—they’re not just nouns, but a story.

Exactly. If you’d asked me about last year, I would have shared mostly the positive things. But if you’d asked during the first year, I might have focused on the challenges we were facing. But now, the Anadea team is delivering, and I’m confident in their abilities. I see how well the team is working, how they’re constantly improving, and how efficiently they’re getting things done. They really know what they’re doing.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.

Need more inspiration?

Read more success stories

-

Visdeal

Dutch ecommerce project

Interview with Willem Bontrup,

A founder and CEO of Visdeal

-

Plei

Success Story of Sports App

Interview with Sebastian Duque,

A co-founder of Plei

-

Turbine

Business management software

Interview with Matthew Stibbe,

A co-founder of Turbine HQ

-

Ham-Nat Сoach

Success Story of e-Learning App

Interview with Pascal Klein,

A co-founder of Ham-Nat Coach

-

Nordic Learning Platform

Success Story of e-Learning App

Interview with Masnad Nehith,

A co-founder of NLP

-

Hobbiamo

Success Story of e-Learning App

Interview with Stephan Kruger,

A founder of Hobbiamo and All Photography Courses platform

-

Pro Med

Online education platform

Interview with Giuseppe Ferrara,

A сo-founder of Pro-Med

-

Bulletin

Swedish online newspaper

Interview with Tino Sanandaji,

A founder and owner of Bulletin

-

Just Play

Social sports app from Australia

Interview with David Argyle,

A founder of Just Play

-

ValeVPN

Virtual private server

Interview with Eric Menzel on the Product, App Development, and Community

-

The Electric Car Scheme

The Attention Small Businesses Deserve

Interview with Tom Eilon, COO