40% Faster Trading: Building a Stable AI Platform for 100k+ Investors

-

Client name

AI Software Company

-

Industry

Fintech

-

Location

US

-

Size

50 employees

-

Duration

from 2024 – present

An innovative US-based company specializing in developing AI and blockchain-based solutions for the financial sector. Their technologies are already used by over 50,000 users and 12 institutional clients in the asset management sector.

Challenges

When the client approached us, they had two core products:

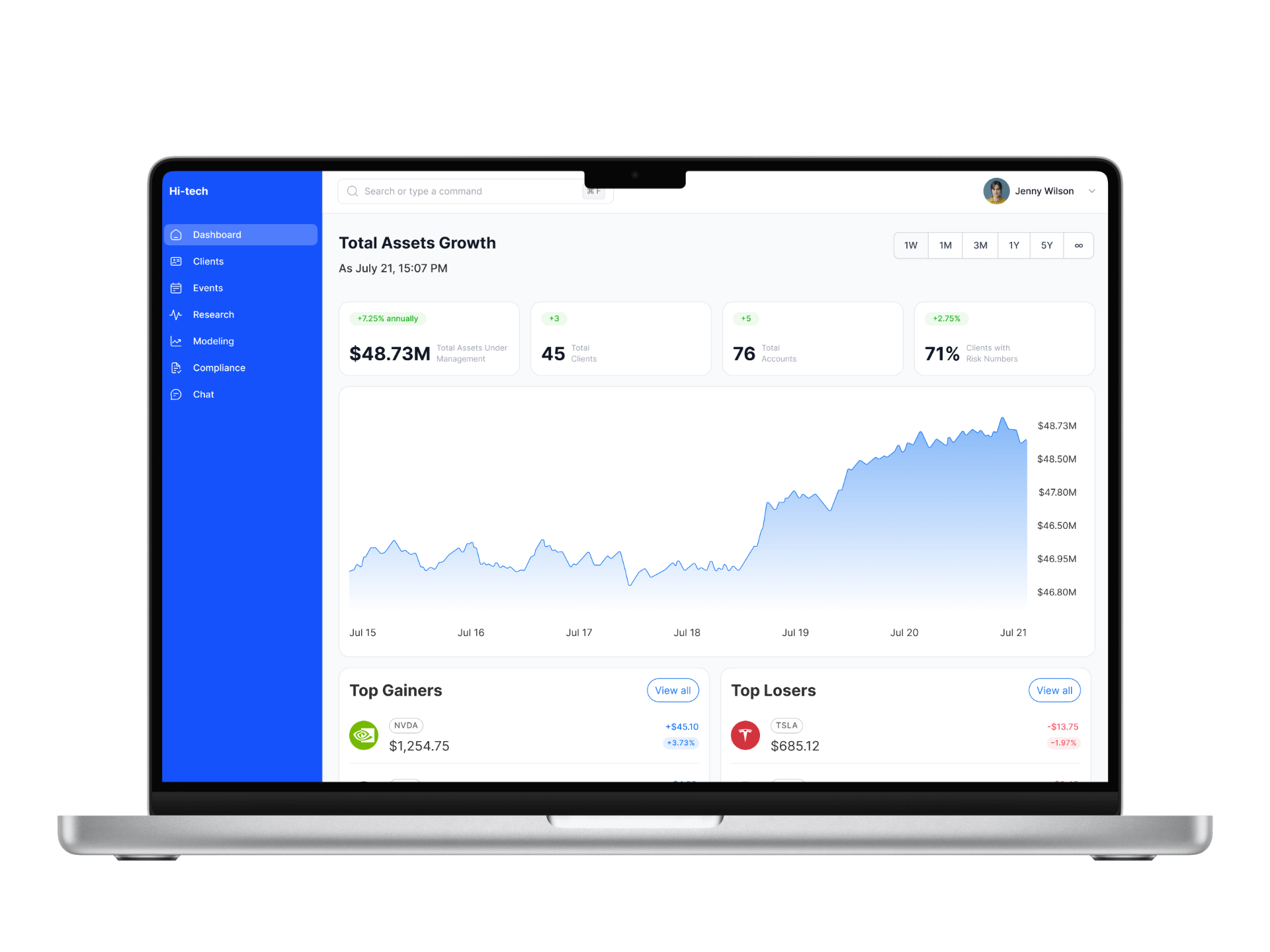

For individual investors: a web and mobile platform where users receive personalized investment recommendations through real-time AI-driven market analytics.

For businesses: a tool for automating financial processes that integrates AI into document management and customer data handling.

The client aimed to build a real-time cryptocurrency and stock trading platform, providing advanced analytics of real-time market data.

Their core challenges stemmed from:

Solution

We developed two mobile applications and a web platform in close collaboration with the client’s technical team:

Mobile app for individual investors

Provides personalized investment recommendations, real-time trading capabilities, AI-powered chat support, and portfolio analytics.

Mobile app for business clients

Focuses on automating financial workflows, AI-driven document processing, and client data management.

Web platform

Serves as a unified interface for all types of users.

Backend Development & Architecture Ownership

We led the design and implementation of core backend services, laying the foundation for a scalable architecture. Our team developed business logic for key APIs using FastAPI.

Microservices Infrastructure

To meet performance and scaling requirements, we implemented a microservices-based architecture. Services communicated asynchronously via AWS SQS. Serverless components powered by AWS Lambda handled specific event-based logic.

Contextual AI Assistant Integration

It was key to enable instant access to an AI helper from any screen without disrupting user experience. That is why we developed a global state management system to handle task interruptions (e.g., pausing chart analysis).

Caching & Performance Optimization

For rapid response and reduced backend load, we integrated Redis as a high-speed caching layer. This significantly improved performance for frequently accessed endpoints.

Machine Learning Integration

Together with the Anadea’s DL team, we incorporated predictive models into the core platform. All accessible via our backend services, they were powered by agentic AI recommendations, price movement predictions, and a conversational AI chat interface.

Feature Delivery

Our work enabled key user-facing features such as:

- Real-time price tracking

- Asset trading (buy/sell)

- Detailed trade analytics

- Integrated notification system (email and push)

- Robust account and security management, including two-factor authentication.

External Systems & API Integrations

We ensured seamless communication with third-party financial APIs like Alpaca, and leveraged various ML pipelines for prediction and recommendation engines.

AI Chat Integration

Implemented an AI assistant accessible from any screen. It analyzes financial queries (“Buy this stock?”, “Portfolio review”) and delivers responses in user-friendly formats: charts, tables, or text recommendations.

Chat Performance Optimization

Enabled instant rendering of AI responses. Complex outputs (charts/images) can be rendered seamlessly within the chat for real-time analysis.

Custom Data Visualization

Built intuitive data visualization tools, overcoming standard library limitations. Developed chart formats preferred by traders that also display mission-critical data.

Ready to Build the Future of AI-Driven Finance?

Services

-

Backend Development

-

Frontend development

-

Mobile app development

-

Solution architecture for chat service

-

ML integrations

-

Support and maintenance

-

UX/UI design

Dedicated Team

-

3

Backend developers

-

2

Frontend developers

-

1

ML engineer

-

1

DevOps engineer

-

2

UX/UI designers

Tech Stack

Python

React Native

FastAPI

MySQL

Redis

PostgreSQL

AWS

SQS

Lambda

CloudWatch

EC2

Claude

OpenAI LLM

Firebase

Business Value

The AI-powered trading platform was built in line with our client’s vision—making goal-oriented investing accessible to individuals and businesses, while overcoming infrastructure and scalability challenges.

Here’s how it transformed their operations:

-

Real-Time Market Reactions

The client can now track prices in real-time and perform trading faster having optimized backend and Redis caching.

-

Zero Downtime Under Load

Resilient microservices infrastructure ensures seamless trading during peak market hours.

-

Smarter Investment Decisions

Integrated ML models deliver predictive signals and personalized recommendations.

-

Stronger User Trust

End-to-end security with 2FA and JWT authentication builds user trust and confidence.

-

Faster Product Iteration

Modular backend and clear API structure sped up development and experimentation.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.

Other Projects

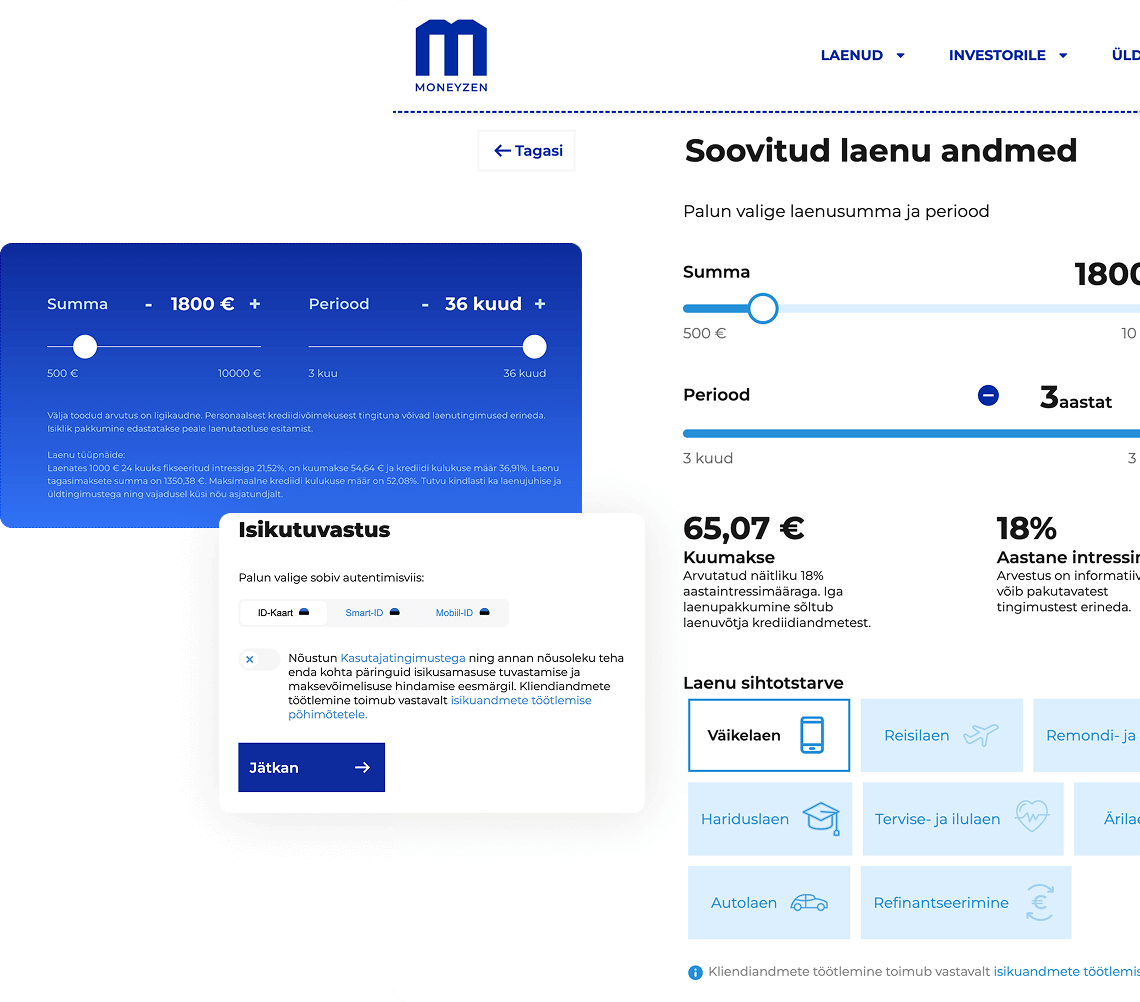

Moneyzen

We transformed MONEYZEN, an AI-powered P2P lending platform, by automating borrower registration via Estonian government integrations, and ensuring real-time compliance with financial regulations.

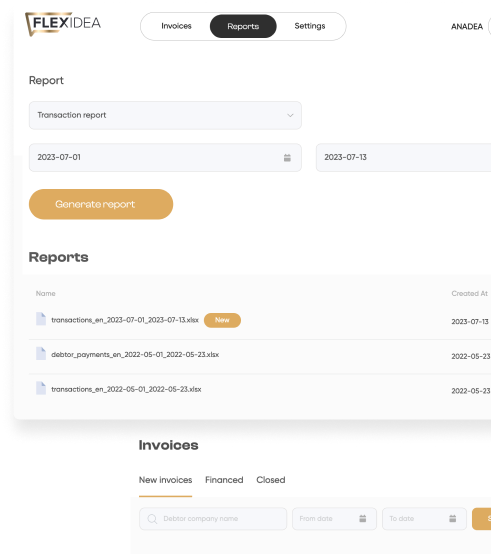

Flexidea

We developed Flexidea's AI-powered invoice financing platform, creating the Service module for representatives and building ML-driven features like auto-filled invoice processing, credit limit management, and real-time state service integrations.