How a Multi-Agent AI System Analyzes 5,000 Investment Opportunities in Hours

-

Client name

Investment Fund

-

Industry

Private Equity

-

Location

Europe

-

Size

500+

-

Duration

October 2023 – present

A major European private equity fund that manages assets worth billions of euros in the healthcare, technology, financial, and industrial services sectors. It invests in Northern Europe, focusing on operational improvements and the long-term growth of its portfolio companies.

Challenges

Every year, the team reviews thousands of potential deals. Each one requires a thorough market analysis and an assessment against dozens of criteria. This is where the core problems emerged.

Time-Consuming Routine

Analysts spent approximately 60 hours per week on market monitoring. Of these, 15-20 hours were spent solely on reviewing news, company earnings reports, and press releases. A valuation could take anywhere from 2 days to 4 weeks, depending on data availability.

Inconsistent Valuation

Different analysts applied different approaches. What one considered a strong opportunity, another would not even view as a viable option. Comparing deals in the pipeline proved nearly impossible due to the lack of a unified methodology.

Fragmented Data in Heterogeneous Sources

Critical information was scattered across different systems – document repositories, CRM, email, Excel spreadsheets, Bloomberg terminals, and financial databases.

Slow Decision-Making

The vast amounts of data that had to be processed manually led to significant delays in decision-making. The team evaluated fewer deals per year, despite constant pressure to increase the deal flow.

Solution

We have created an artificial intelligence platform that goes beyond simply automating tasks to fully enhance the investment deal sourcing process. Its primary interface is a user-friendly chat, similar to ChatGPT, through which users can ask questions and receive ready-made analytical reports.

The platform is built on a four-component architecture:

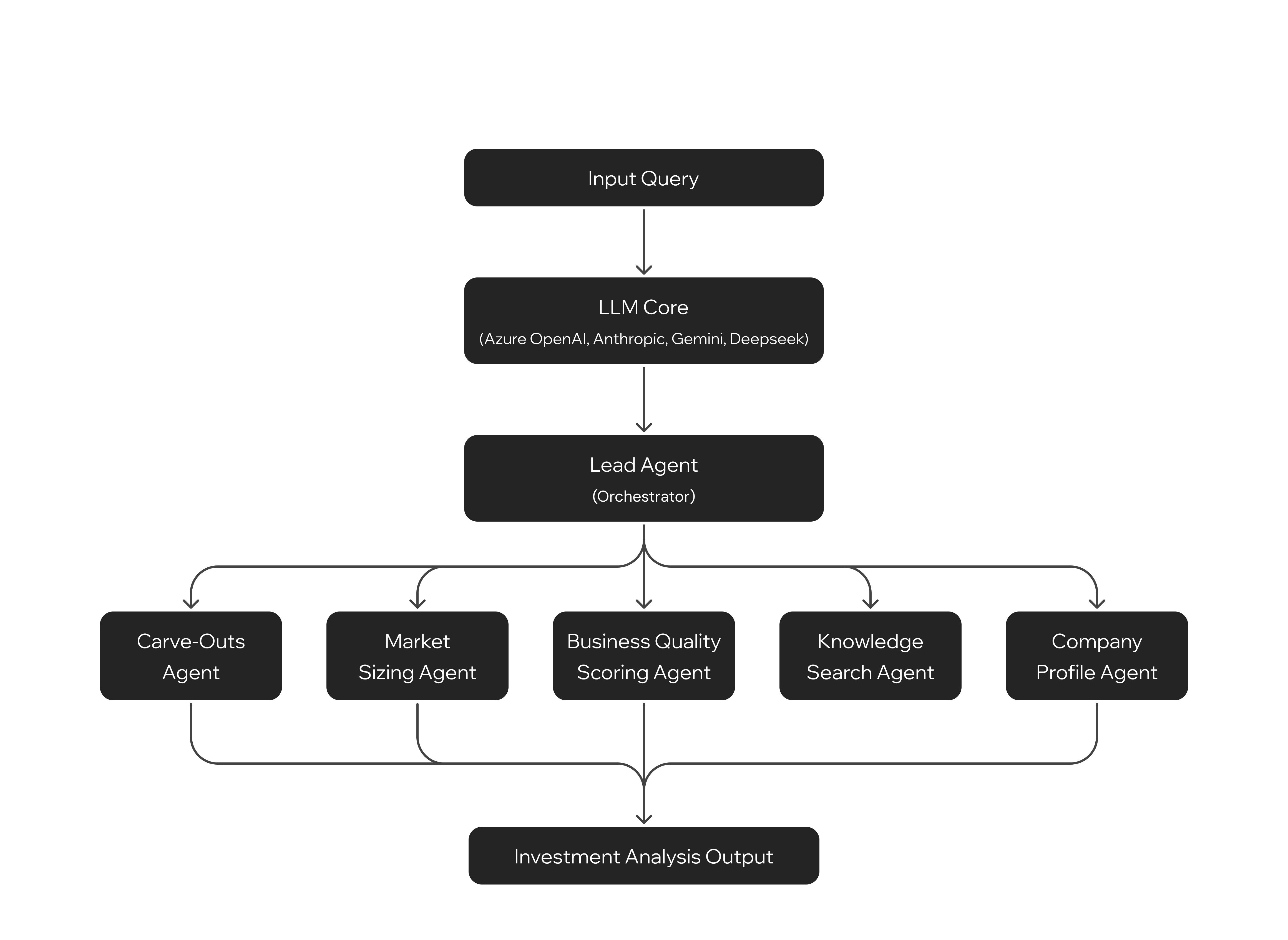

LLM Core

Utilizes state-of-the-art AI models (including Azure OpenAI, Gemini, Anthropic, and Deepseek) to process investment documents, evaluate opportunities, and extract key data from diverse sources, all within a consistent analytical framework.

Orchestration Layer

This layer features a lead agent that acts as a controller, taking user requests from the chat and dynamically assigning tasks to a network of specialized sub-agents.

Knowledge Integration

The platform creates a unified data environment by seamlessly connecting multiple information sources: internal documents, financial databases, CRM systems, company policies, and web-sourced data.

Specialized AI Agent Network

We built GAIA – five specialized AI agents, each targeting a specific chokepoint. All are built on the LangGraph and LangChain frameworks and are coordinated by a lead agent.

Five Specialized Agents

1

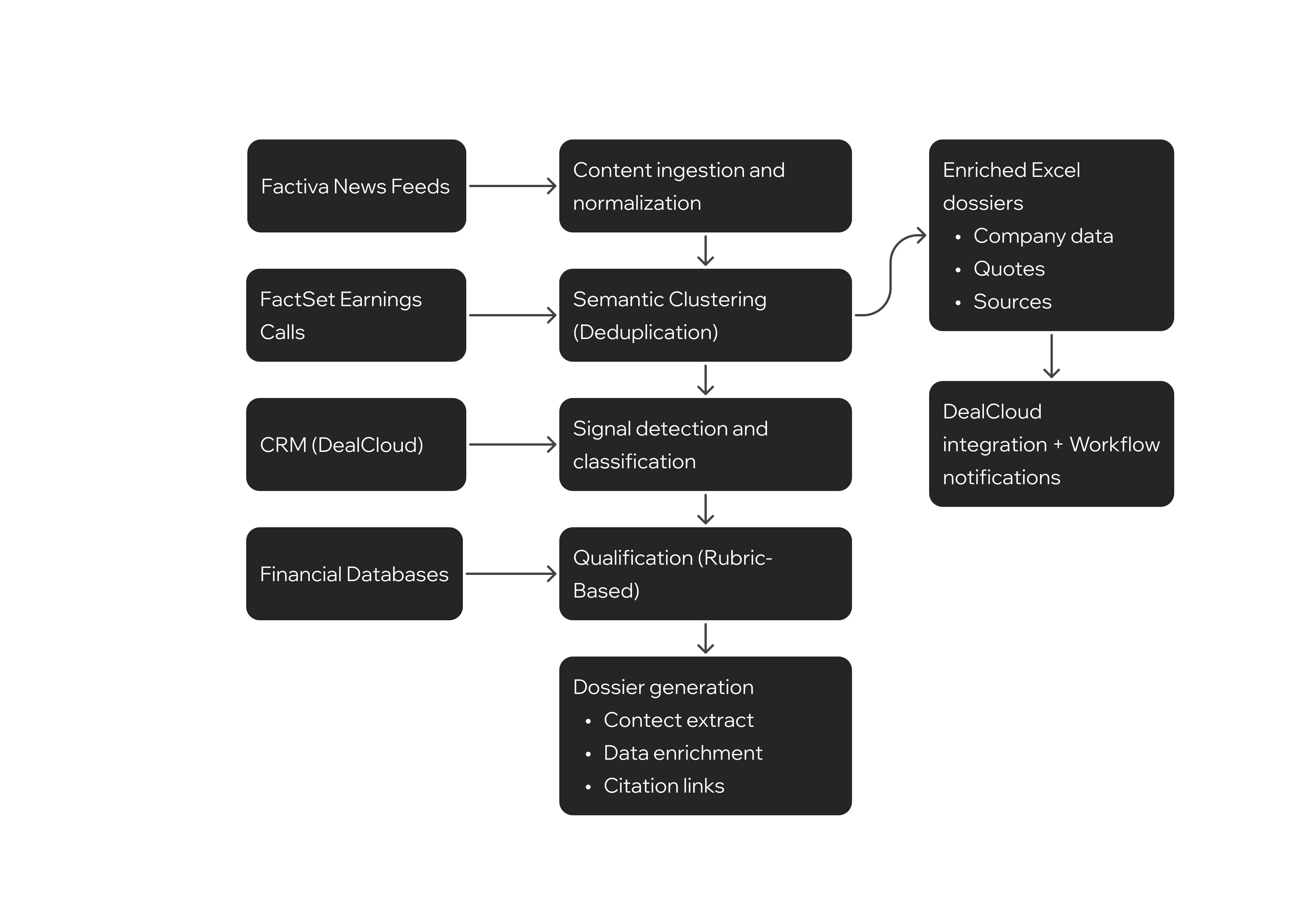

Carve-Outs Agent

Watches Factiva and FactSet around the clock for divestiture signals. Groups duplicate coverage using semantic clustering (one announcement typically spawns 20+ articles). Filters against the fund's criteria (deal size, geography, sector fit). Packages findings into Excel dossiers with executive quotes, rationale, timeline, and clickable source links. Pulls in financials, ownership data, M&A history from internal and external databases.

Monitoring time dropped 85%. No relevant signals get missed.

2

Market Sizing Agent

Walks analysts through defining scope (industry, geography, segments, solution types). Then goes out and collects data from Gartner, IDC, Statista, internal research. When sources disagree (they always do), it reconciles through weighted averages with confidence bands. Calculates TAM/SAM/SOM, models growth, documents every assumption, generates charts in house style. Analysts can tweak any assumption and get instant recalculation.

Market analysis takes 4-6 hours instead of 3 days.

3

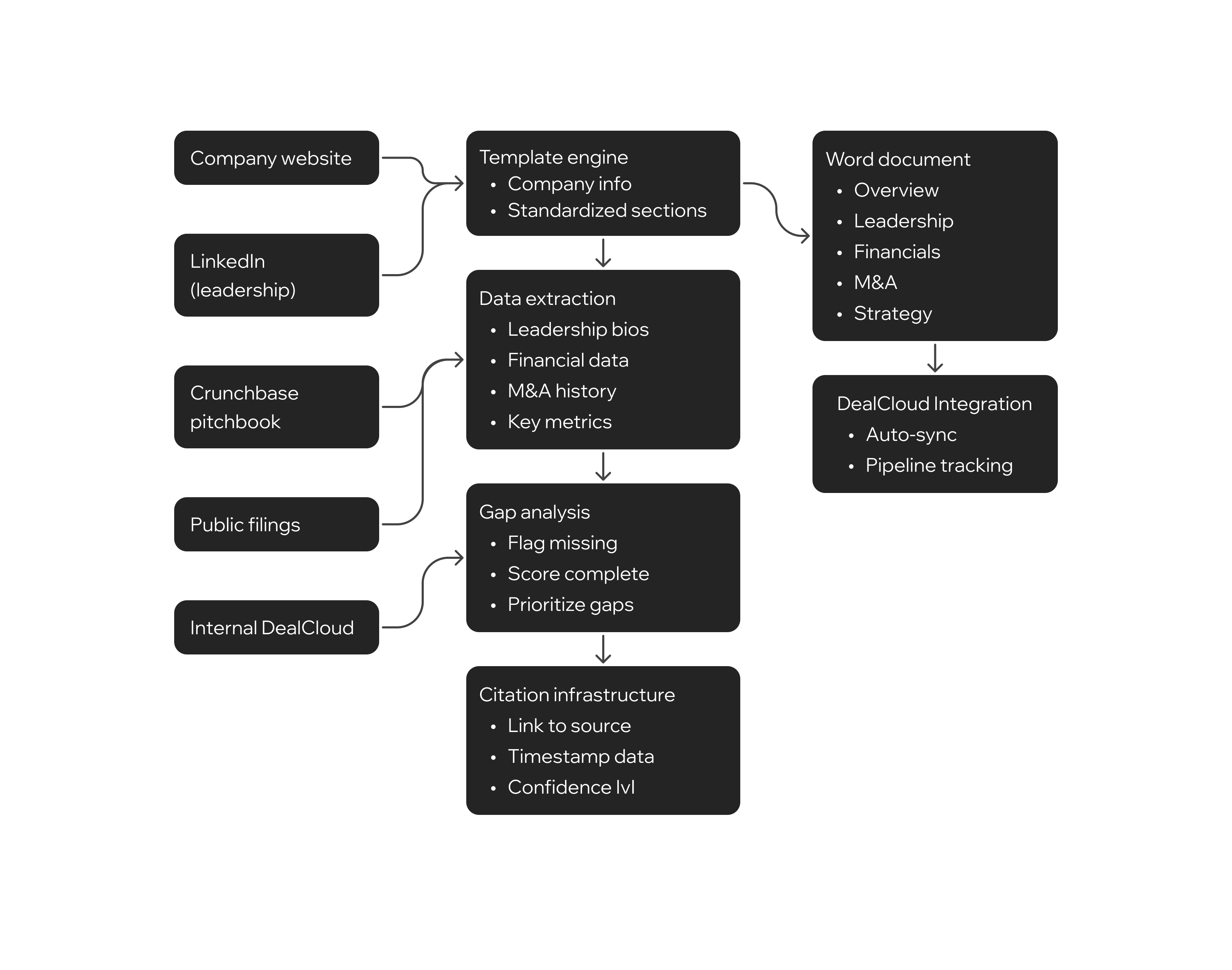

Company Profile Agent

Pulls company data from websites, LinkedIn, Crunchbase, Pitchbook, public filings, internal CRM. Structures everything identically (overview, leadership, financials, M&A history, strategic position). Flags what's missing. Links every fact to its source. Exports to Word in house format. Same structure every time means you can actually compare 50 profiles side-by-side.

Profile creation takes 90 minutes instead of 10 hours. Data completeness up 40%.

4

Knowledge Search Agent

Conversational search through the fund's entire document history using RAG. Understands what you're actually asking, identifies the relevant sector context, finds applicable frameworks and past analyses. Returns specific excerpts with links and guidance on applying them to your current situation.

Finding prior work takes 2 hours instead of 6.

5

Business Quality Index Agent

Reads through all due diligence materials and scores against 36 criteria (strategic position, revenue quality, market dynamics, competitive moat, management strength, unit economics, operational capabilities, exit routes, etc). Validates data, calculates weighted indices, flags coverage gaps, generates branded PDF briefings with spider charts and heatmaps. Every score links directly to supporting evidence.

Full assessment takes 4 hours instead of 40. Investment committee prep accelerated 8X.

Still spending weeks on deal screening?

Services

-

Agentic AI custom software development

-

Frontend development

-

Backend development

-

UX/UI design

Tech Stack

Azure OpenAI

Gemini

Anthropic

Deepseek

Azure CosmosDB

Apache Gremlin

Langchain

LangGraph

Microsoft Azure

FastAPI

Chainlit

React

Recoil

Redux

Redux Toolkit

RTK Query

TanStack Query

MUI

Business Value

-

Robust Scalability of Analysis

Specialists can now analyze over 5,000 company profiles in a matter of hours, enabling the identification of promising investment opportunities at early stages.

-

Acceleration of Key Processes

The preparation time for investment committee presentations has been reduced from days to minutes through the automated generation of slides and data visualizations.

-

Focus on Strategic Tasks

By automating routine document processing and data collection, investment analysts free up their time to concentrate on high-value activities: building relationships, conducting strategic market analysis, and developing investment theses.

-

Unified Evaluation Framework

The implementation of standardized assessment criteria eliminates subjective variances in team members' approaches, guaranteeing an objective and comparable analysis of investment proposals regardless of their industry or geography.

Contact us

Let's explore how our expertise can help you achieve your goals! Drop us a line, and we'll get back to you shortly.

Other Projects

Agentic AI Platform for Trading

We developed an AI-driven trading platform that combines analytics and intelligent recommendations for investors. By moving to a microservices architecture with Redis caching and AWS SQS, we increased performance by 40%.

StreetEasy

We helped StreetEasy, New York’s leading real estate platform, scale its engineering capacity during a period of rapid growth. Our developers contributed to backend optimization, microservices architecture, and the evolution of their internal tools and customer-facing features.